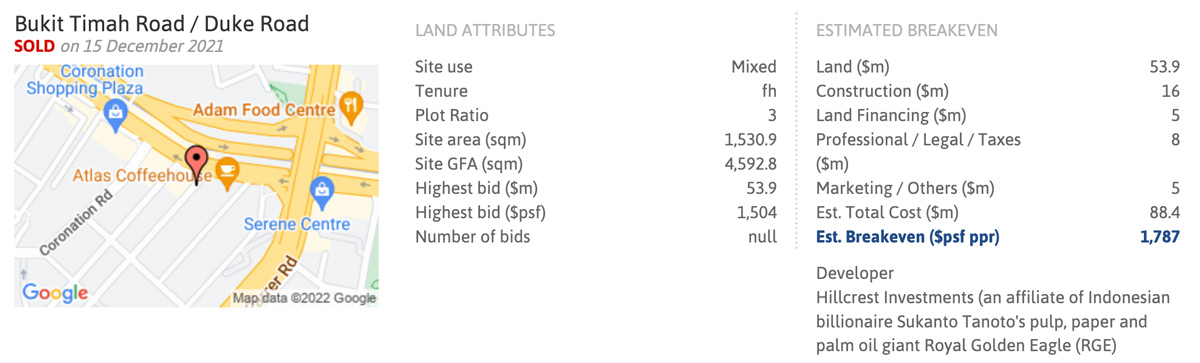

Three adjoining freehold redevelopment sites were sold to Hillcrest Investments, an affiliate of Indonesian billionaire Sukanto Tanoto's pulp, paper and palm oil giant Royal Golden Eagle (RGE) on Dec 2021.

The plot at 551 to 553 Bukit Timah Road has a land area of 7,727 sq ft, while the site at 6 to 8 Duke's Road, together with the driveway, has a land area of 8,752 sq ft.

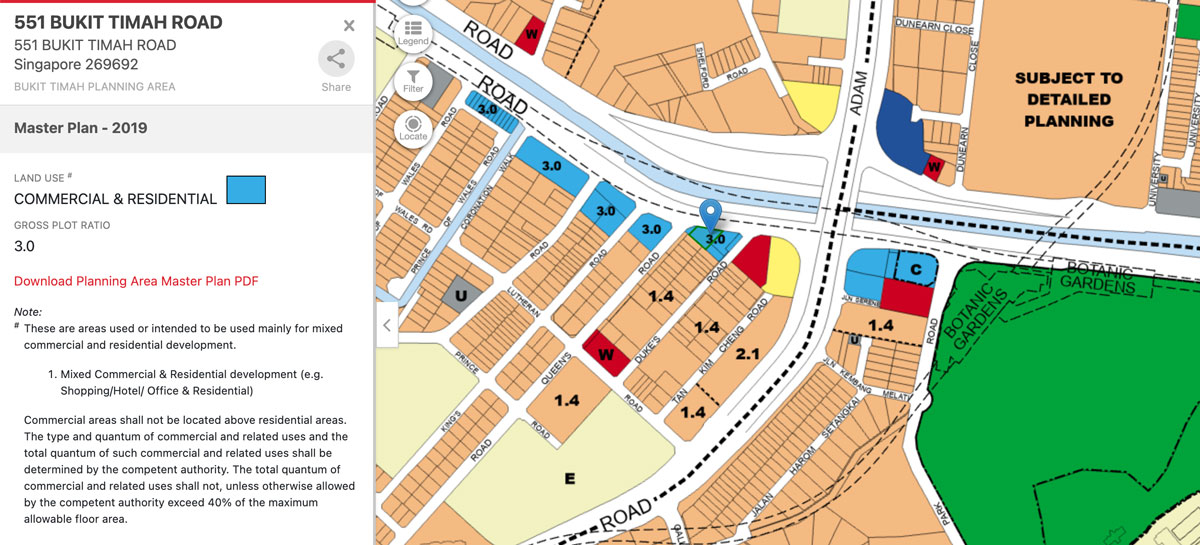

In total, the freehold 16,479 square foot (sqft) site is zoned for residential and commercial use. It has an allowable height of up to 5 storeys under the Urban Redevelopment Authority's Master Plan 2019.

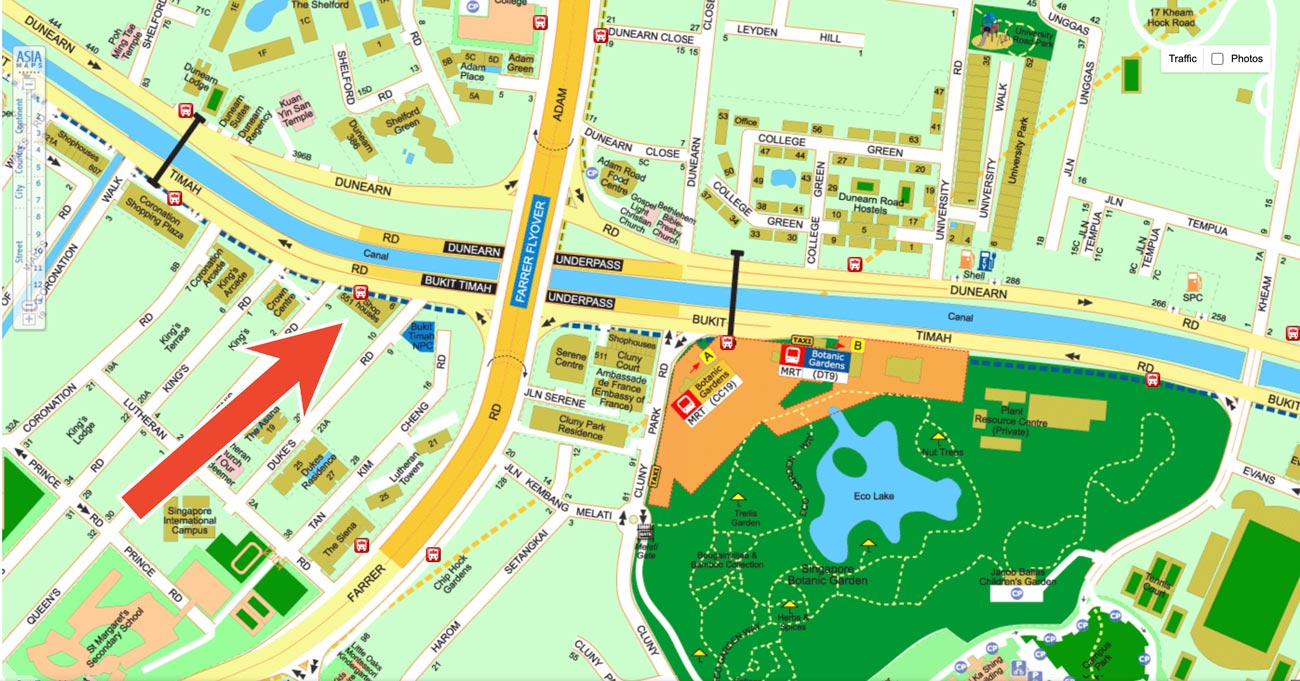

The entire property is bounded by Duke's Road, Queen's Road and Bukit Timah Road.

The deal price of $53.9m works out to a land rate of about S$1,504 psf ppr.

The property can be potentially be redeveloped into a boutique development comprising 32 residential units with an average size of 85 square metres (sq m), with retail units on lower levels.

15 Dec 2021

THREE adjoining freehold redevelopment sites near the Botanic Gardens have fetched S$53.9 million in a collective sale to Hillcrest Investments, an affiliate of Indonesian billionaire Sukanto Tanoto's pulp, paper and palm oil giant Royal Golden Eagle (RGE).

Comprising a total of 8 walk-up apartments and 4 ground-floor shops, the property is located at 551 to 553 Bukit Timah Road and 6 to 8 Duke's Road, and also includes a driveway. They span a total land area of 16,479 square feet (sq ft).

The deal price works out to a land rate of about S$1,504 per square foot per plot ratio, inclusive of a development charge at the gross plot ratio of 3.0, assuming 60 per cent of the gross floor area is for residential use and 40 per cent for commercial use, said JLL executive director Tan Hong Boon.

JLL as the marketing agent said in a press statement on Wednesday (Dec 15) that the en bloc tender closed last week with "good interest", given the lowered reserve price for this second exercise. There were 3 formal submissions received at the close of the tender.

25 Oct 2021

THREE adjoining mixed-use redevelopment sites at 551 to 553 Bukit Timah Road, 6 to 8 Duke's Road and a driveway have been relaunched for sale with a lower guide price of S$53.8 million, sole marketing agent JLL said on Monday (Oct 25).

This translates to S$1,502 per square foot per plot ratio (psf ppr), inclusive of development charge at a gross plot ratio of 3.0. It also assumes 60 per cent of the gross floor area (GFA) will be for residential and the remaining 40 per cent for commercial use.

Previously, the plots had a guide price of S$62.5 million when launched for collective sale in January 2021, translating to S$1,658 psf ppr. This was assuming 80 per cent of GFA was for residential and 20 per cent was for commercial use.

All owners have agreed to the collective sale of their respective developments, which means no Strata Titles Board application for a sale order is needed.

The freehold 16,479 square foot (sq ft) site is zoned for residential and commercial use. It has an allowable height of up to 5 storeys under the Urban Redevelopment Authority's Master Plan 2019.

The plot at 551 to 553 Bukit Timah Road has a land area of 7,727 sq ft, while the site at 6 to 8 Duke's Road, together with the driveway, has a land area of 8,752 sq ft.

26 Jan 2021

THREE adjoining mixed-use redevelopment sites at 551 to 553 Bukit Timah Road, 6 to 8 Duke's Road and a driveway have been put on the market via collective sale with a guide price of S$62.5 million.

The freehold 16,479 square foot (sq ft) site is zoned for residential and commercial use. It has a gross plot ratio of 3.0 and an allowable height of up to five storeys under the Urban Redevelopment Authority's Master Plan 2019, sole marketing agent JLL said on Tuesday.

Assuming 80 per cent of the gross floor area (GFA) is for residential and 20 per cent is for commercial use, the unit land price is about S$1,658 per sq ft per plot ratio (psf ppr), inclusive of development charge at the gross plot ratio of 3.0.

After factoring in an additional 7 per cent bonus GFA for balconies for the residential component, the unit land rate will fall to S$1,621 psf ppr, inclusive of development charge.

Tan Hong Boon, JLL executive director of capital markets, said the property presents developers a rare opportunity to redevelop a boutique freehold development with over 40 residential units averaging 85 square metres with the ground floor for retail units.