AN AIR of caution prevailed at the latest government land sales (GLS) tender closings for two 99-year leasehold private housing sites near Beauty World and Hillview MRT stations.

The number of bids received was below market expectations.

However, the top bids for both plots came in within the range of expectations indicated by property consultants polled by The Business Times before the tenders for the two sites closed on Thursday (Nov 3).

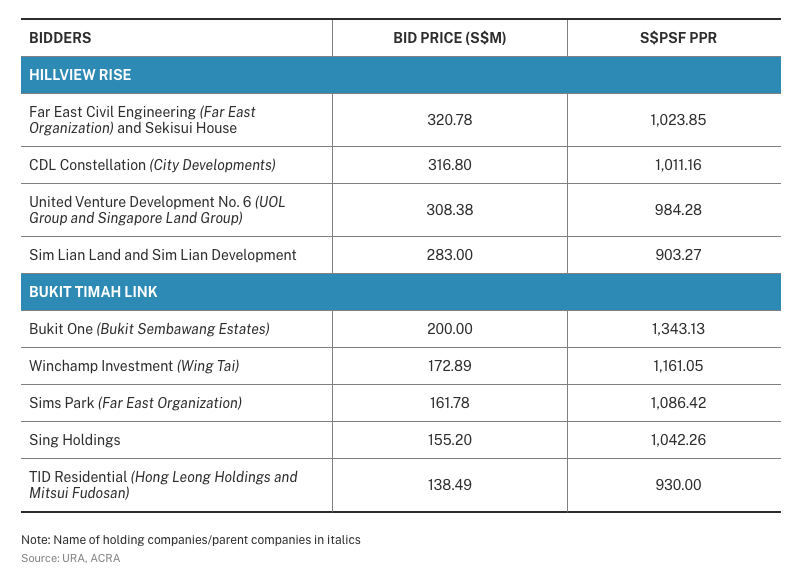

The Hillview Rise site, which can generate about 335 homes, received four bids. A partnership between Far East Organization and Sekisui House placed the top bid of S$320.78 million, or nearly S$1,024 per square foot per plot ratio (psf ppr).

The site along Bukit Timah Link, a stone’s throw from Beauty World MRT station, fetched five bids.

Bukit Sembawang Estates’ top bid of S$200 million or S$1,343.13 psf ppr was 15.7 per cent more than the second-highest bid from Wing Tai.

Said JLL Singapore’s senior director of research and consultancy, Ong Teck Hui: “It was thought that the Bukit Timah Link site, which is relatively small and therefore less risky, would generate greater interest among developers, but only five parties bid for it. The top bid was, however, much more optimistic than the second-highest bid. While the inventory of unsold units remains low and there is a need for developers to replenish their land banks, there seems to be greater caution in bidding for sites in view of rising interest rates, the effects of the recent cooling measures and macroeconomic uncertainties.”

Provisional tender results for 99-year private housing sites

This is the maiden tender closing following the late-September property cooling measures.

Also noting the more cautious approach among property developers, Nicholas Mak, the head of research and consultancy at ERA Realty Network, said the top bid of S$1,023.85 psf ppr for the Hillview Rise site is lower than the S$1,068 psf ppr land rate paid in 2018 for the nearby Midwood condo site. “The distance between the Midwood and Hillview Rise sites is only about 230 metres,” he added.

The S$1,023.85 psf ppr top bid for the latest Hillview Rise site was just 1.3 per cent above the second-highest bid, by City Developments. Edmund Tie’s head of research and consulting, Lam Chern Woon, said one reason for the relatively close bids for this site could be that developers are concerned about supply and price competition from the future development on the Dairy Farm Walk site, which was awarded in March this year at a significantly lower S$980 psf ppr.

Summing up Thursday’s tender closing, Knight Frank’s head of research for Singapore, Leonard Tay, said: “The economic outlook has taken a pessimistic turn with increasing interest rates, inflation and recessionary pressures. Despite this, developers are still keen to acquire land, to provide new products to a private residential market that is currently under-supplied.”

“These are challenging times indeed for developers, having to manage the risks of high construction costs, government intervention with cooling measures, paying non-remissible Additional Buyer’s Stamp Duties (ABSD) as well as having to sell out within five years so as not to be liable for even more ABSD. Another dampener for developers is a revision in definitions of floor area, including air-conditioner ledges to be included as gross floor area; the changes will eat into developers’ saleable area and margins for condo projects.”

In addition, with increasing interest rates, developers now have to consider whether some homebuyers will camp on the sidelines, adopting a watch-and-wait approach until economic uncertainties play themselves out, Tay added.

CBRE’s head of research for South-east Asia, Tricia Song, expects launch prices of S$1,800 to 1,900 per square foot (psf) for the new project that will come up on the Hillview Rise site, and S$2,200 to 2,300 psf for the new project on the Bukit Timah Link plot.

Chng Kiong Huat, the chief executive of Bukit Sembawang, the top bidder for the Bukit Timah Link plot, said: “We plan to curate a cosmopolitan village lifestyle within a 20-storey development with 160 apartment units, that we believe would appeal to young families and investors. This lifestyle concept would fit well into this location with its village vibe, and will provide an attractive option for buyers looking for a unique lifestyle, as they enjoy the gentrification and transformation of the Beauty World precinct.” Within walking distance of the site are the Bukit Timah Nature Reserve and Bukit Batok Nature Park, as well as various retail and food and beverage options.

Marc Boey, an executive director of Far East Organization, speaking on behalf of the joint venture between the company and Sekisui House, said that the Hillview Rise site presents an “excellent opportunity for the two of us to create another notable residential property project in the Upper Bukit Timah enclave”.

The partners’ proposed scheme for the Hillview Rise site will comprise two blocks of 27 storeys, with around 330 private homes.

Located within an established private residential estate, the Hillview Rise land parcel is easily accessible via major roads/expressway and Hillview MRT station.

Schools such as CHIJ Our Lady Queen of Peace and Assumption English School are located nearby. Shopping malls such as The Rail Mall and HillV2 provide a wide array of shopping, dining and entertainment options nearby. The land parcel is next to Hillview Community Club and near Bukit Batok Nature Park.