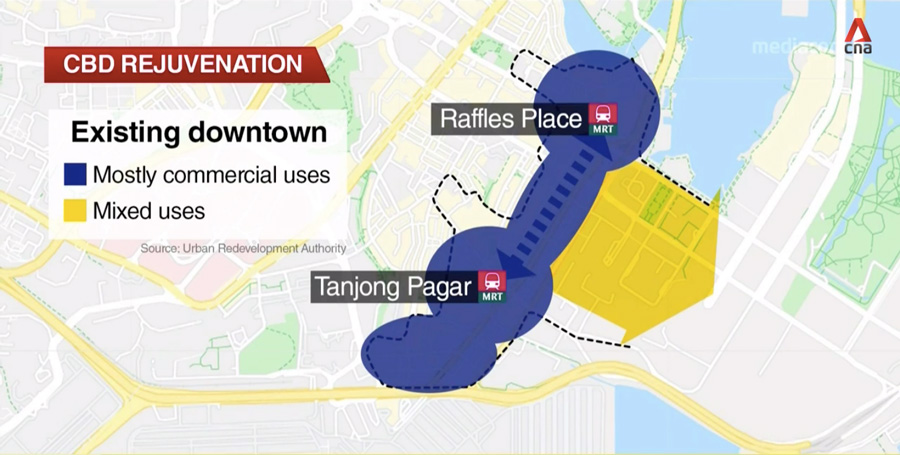

In 2019, URA introduced the Central Business District (CBD) Incentive Scheme to better support the continued growth and evolution of our CBD as a dynamic global hub, and reposition our CBD as a 24/7 mixed-use district so that the CBD will not only be a place to work, but also a vibrant place to live and play in.

The incentives aim to encourage the conversion of existing, older, office developments into mixed-use developments that will help to rejuvenate the CBD by:

The incentives are calibrated to encourage:

See : Straits Times, 27 Mar 2019, URA Draft Master Plan: Higher plot ratios in CBD for converting offices to hotels, homes

See : Straits Times, 27 Mar 2019, URA unveils plan to revitalise Orchard Road, CBD

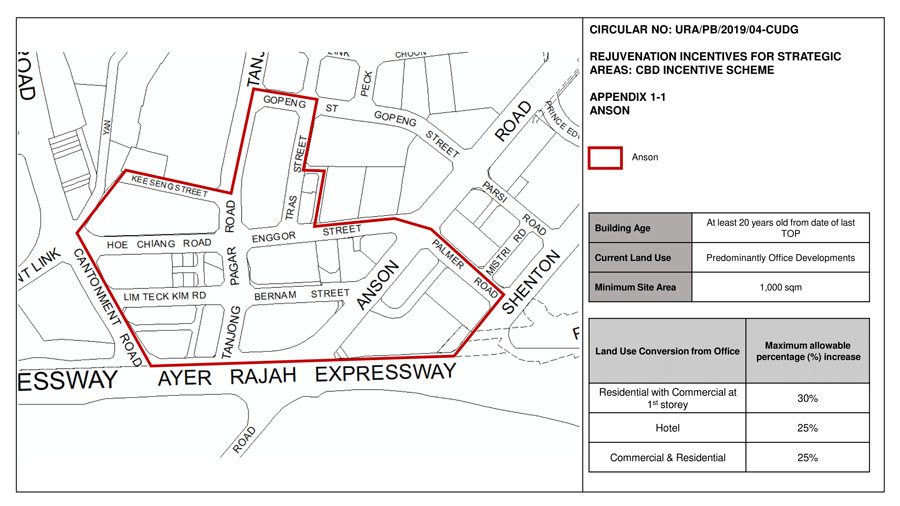

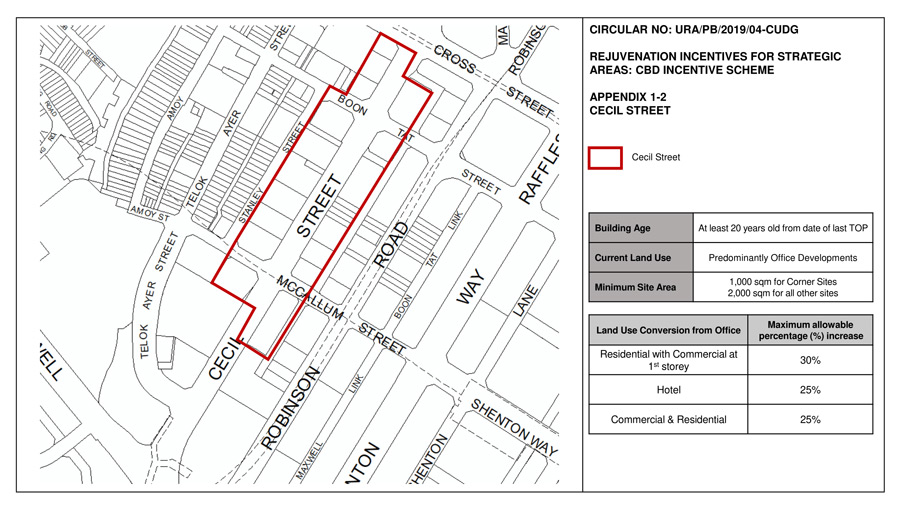

Eligibility for the scheme is subject to the criteria as outlined:

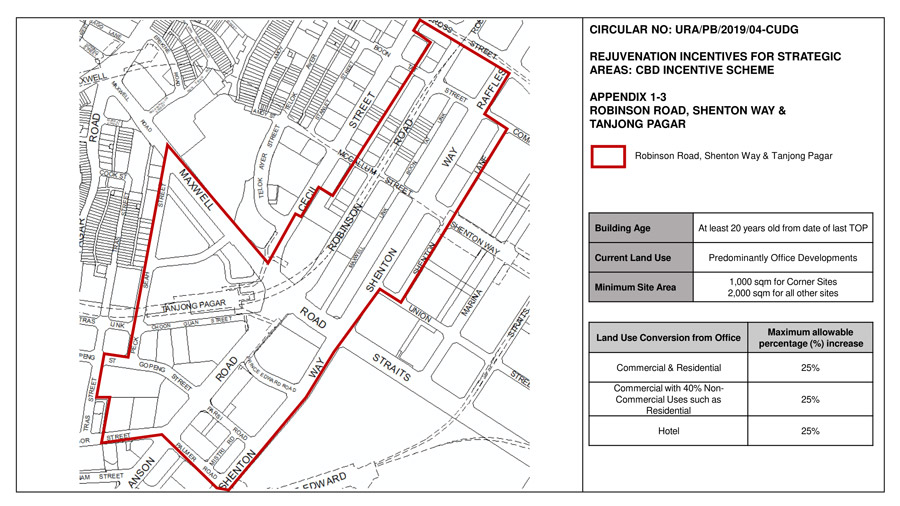

To safeguard the quality of the resultant developments, only sites that meet a minimum site area will be eligible for the incentives. This requirement will vary according to specific considerations within each area to avoid creating a wall-like environment:

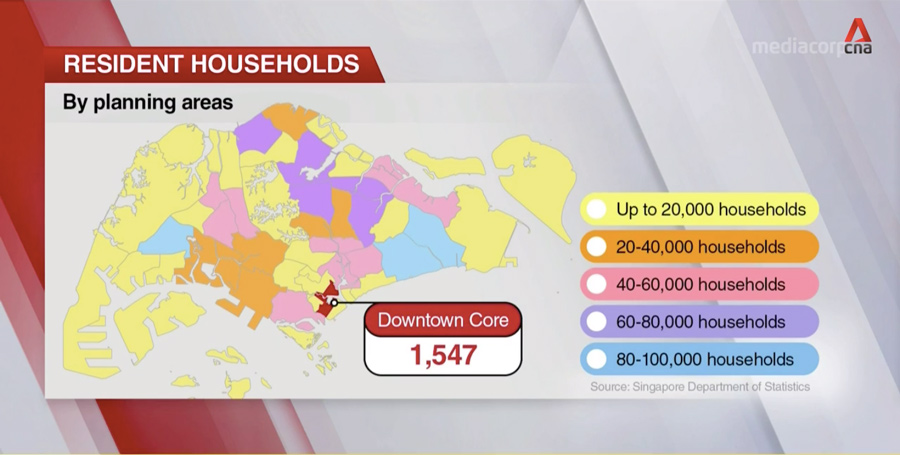

The CBD remains as one of the currently least densely populated areas of the country.

CBD Incentive Scheme : Location : Anson

CBD Incentive Scheme : Location : Cecil Street

CBD Incentive Scheme : Location : Robinson Road, Shenton Way & Tanjong Pagar

See : Business Times, 13 Apr 2019 , Rejuvenating CBD with new integrated buildings 'visionary': JLL

Firstly, we believe the scheme will transform Singapore's downtown CBD to meet modern demands. From our work with global corporate clients, we know that employees of today prioritise hospitality, health and lifestyle amenities in their choice of office locations. The scheme can reinvigorate the CBD to meet these needs by encouraging new mixed developments, bringing together new residents, tourists and digital nomads of all ages into the district, and allow for more 24/7 social activities and events.

Secondly, we foresee that the CBD Incentive Scheme could accelerate the decentralisation strategy to enhance sustainability and reduce commuting. As older office stock is withdrawn and redeveloped, office occupiers displaced by the withdrawal of older stock in the CBD will need new premises, giving the government scope to release more land parcels in decentralised gateways, such as Jurong East, Woodlands and Tampines to expedite the development of these hubs.

Thirdly, with limited new supply of office space in the CBD and potential initiation of redevelopment projects over the next five years, we expect office rents to continue to rise, barring any demand shocks. This would likely widen the rental gap between CBD and suburban hubs, and motivate more businesses to consider moving some operations out of the CBD.