THE latest state tender closing shows developers being cautious about acquiring large private residential development sites, despite running low on unsold inventory and the recent successful launches such as Piccadilly Grand and LIV@MB.

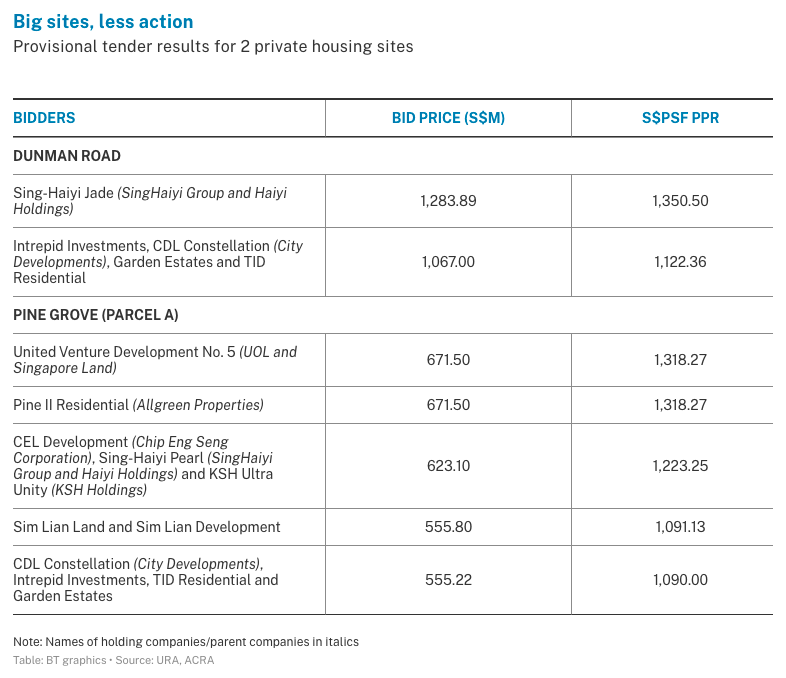

Two relatively large 99-year leasehold plots along Dunman Road (which can yield about 1,040 units) and Pine Grove area (which can be developed into a maximum of 520 units) fetched just 2 bids and 5 bids respectively - lower participation than what most property consultants had been expecting.

SingHaiyi Group and Haiyi Holdings’ top bid of S$1.28 billion or S$1,350.50 per square foot per plot ratio (psf ppr) for the Dunman plot, which is near Dakota MRT station and beside the Geylang River, was within the S$1,250-1,400 psf ppr expected by the market.

The Dunman Road site is less than 100 metres from Dakota MRT station on the Circle Line and next to Geylang River

The top bid for Pine Grove Parcel A - S$671.50 million or S$1,318.27 psf ppr - was at the higher end of market expectations, noted JLL senior director Ong Teck Hui.

The highest bid by a 80:20 partnership between UOL : U14 +0.27% and Singapore Land : U06 -1.18% was just S$800 more than the next highest bid, by Allgreen Properties’ Pine II Residential - one of the narrowest winning margins at a state land tender.

OrangeTee & Tie’s CEO, Steven Tan, estimates that the respective new projects on both sites could be launched at S$2,300-2,400 psf.

Desmond Sim, CEO of Edmund Tie & Company, says the top bid for the Dunman site coming in within expectations is due to the higher number of housing units it can yield. The site’s developer risks having to fork out 35 per cent additional buyer’s stamp duty (ABSD) on the land price if it fails to complete the new residential project on the site and sell all units within 5 years.

“There will be no dearth of units to be launched in the vicinity with at least 2 big projects - along Thiam Siew Avenue and Jalan Tembusu on sites sold earlier - that could potentially come on the market before the new project on the Dunman site, mopping up a chunk of private housing demand in the locale,” he added.

Pine Grove Parcel A, because its unit yield will be about half that of the Dunman plot, has a relatively lower development risk. “Moreover, there are not too many units in the launch pipeline in this vicinity in the immediate future, so the successful bidder can enjoy a first-mover advantage and has more room for a competitive land bid.”

CBRE’s head of research for South-east Asia, Tricia Song, too highlighted the lack of new supply in the vicinity for over 10 years. In addition, Pine Grove Parcel A is close to popular schools such as Henry Park Primary and a short drive from lifestyle hub Holland Village.

JLL’s Ong, commenting on the site drawing just 5 bids, said: “It appears that many developers are even reluctant to bid for a medium-sized site like Pine Grove (Parcel A) which can generate 520 residential units.”

ERA Realty Network’s head of research and consultancy, Nicholas Mak, observed: “Typically, the sweet spot of residential projects for most developers is between 200 and 500 units. Projects ranging between these sizes would provide some economies of scale but minimise the risks of large developments, such as the 5-year sales deadline under ABSD rules.”

Mak also noted that few developers have the appetite for residential land parcels with price tags exceeding S$1 billion. “Most developers, even those with strong financial capabilities, would prefer to diversify their development risk.”

Agreeing, Ong of JLL said that developers’ quest to replenish land banks could be tempered by geopolitical uncertainties, slower economic conditions, rising interest rates and higher construction costs. “In the current market, URA (Urban Redevelopment Authority) should avoid launching large residential sites for sale as they are more risky and there is less demand. It may be more appropriate to launch sites that can generate fewer than 500 units,” he added.

UOL Group chief investment and asset officer, Jesline Goh, commenting on the group’s top bid for the Pine Grove plot, said: “Given the site’s strong attributes, we expect to see keen interest from both homebuyers and investors.”

UOL is planning to develop the site into a 520-unit residential development nestled in the established private residential enclave near Mount Sinai Rise.

SingHaiyi Group declined to comment on its top bid for the Dunman plot.