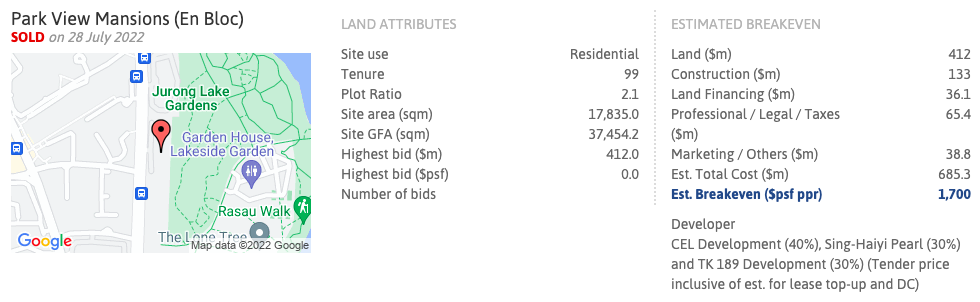

Park View Mansions was sold in July 2022 for $260m, to a consortium of 3 developers, namely Singapore-listed Chip Eng Seng and its partners, KSH Holdings and SingHaiyi Group.

Its $260 million sale price translates to a land rate of $1,023 per square foot per plot ratio (psf ppr), including the estimated differential premium and lease top-up to a fresh 99 years.

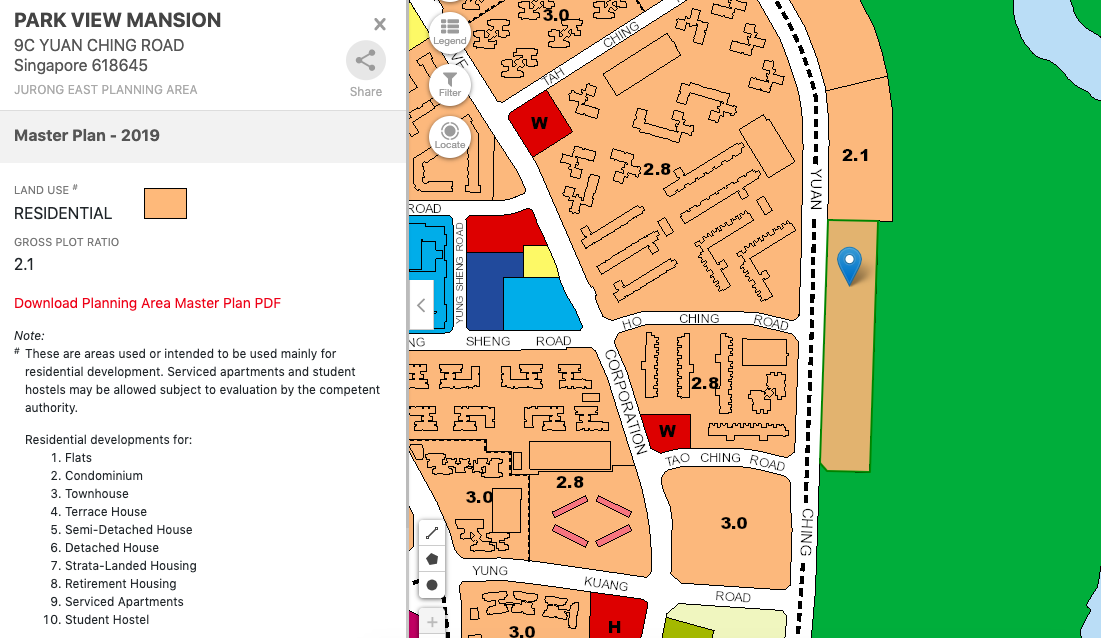

Located near Lakeside and Chinese Garden MRT stations, the development, which is within the Jurong Lake District, sits on a land area of 191,974 sq ft and is zoned for residential use with a gross plot ratio of 2.1. It can be redeveloped up to a gross floor area of 403,145 sq ft, and can potentially yield 440 units.

The redeveloped project will be called Sora.

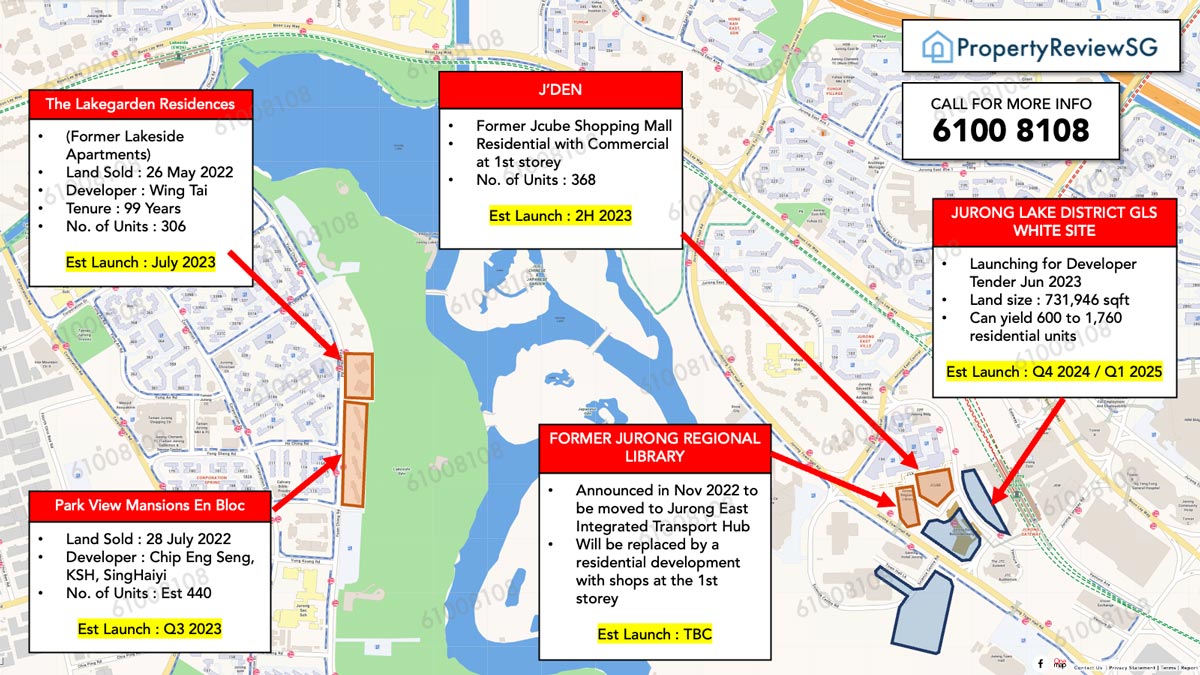

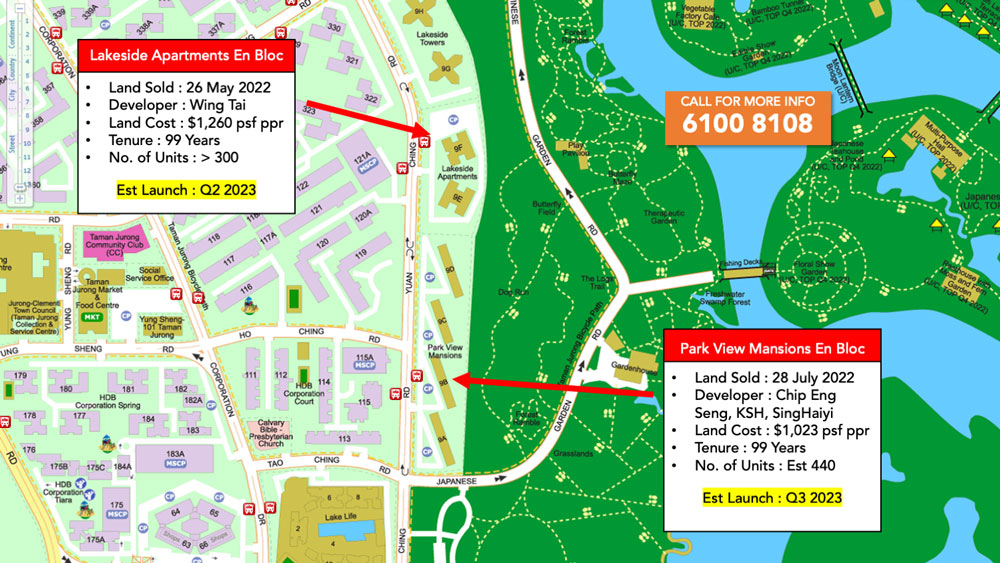

Within the Jurong area, extending westwards till Yuan Ching Road, there are a number of upcoming developments :

View of Park View Mansions from along Yuan Ching Road

See more information on :

Aerial view of Park View Mansions, beside the other recently enbloc project, Lakeside Apartments

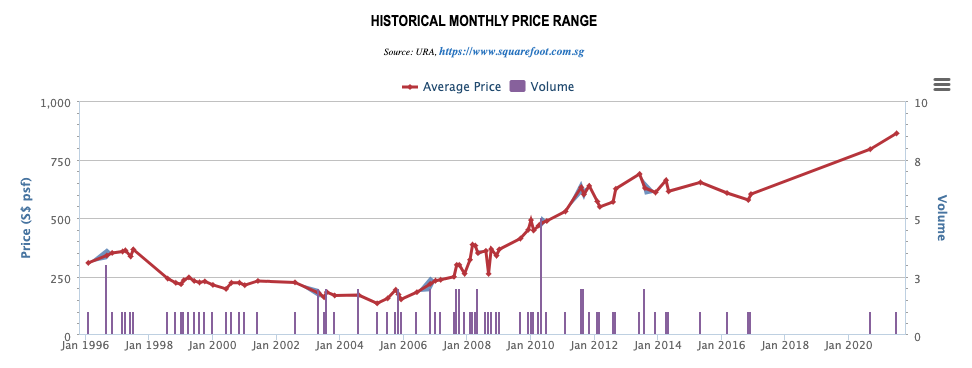

Park View Mansions Historical Price Trends

28 July 2022

Three Singapore developers are stepping up land banking via the collective sale market, with their latest tie-up being the acquisition of Park View Mansions in Yuan Ching Road for $260 million.

Citing higher costs, construction delays due to labour shortage and supply disruptions, as well as macroeconomic uncertainties arising from the spike in inflation and interest rates, Chip Eng Seng told the Singapore Exchange on Thursday (July 28) that, for the Park View acquisition, it is "prudent to manage these risks by collaborating with suitable partners whenever possible".

Its $260 million sale price translates to a land rate of $1,023 per square foot per plot ratio (psf ppr), including the estimated differential premium and lease top-up to a fresh 99 years.

Located near Lakeside and Chinese Garden MRT stations, the development, which is within the Jurong Lake District, sits on a land area of 191,974 sq ft and is zoned for residential use with a gross plot ratio of 2.1. It can be redeveloped up to a gross floor area of 403,145 sq ft.

11 Dec 2018

Park View Mansions will relaunch on Wednesday its collective sale tender with a 22 per cent lower reserve price than before, making it the latest case of owners dialling down their expectations amid a quieter en bloc market.

More than 80 per cent of the owners at the 191,974 square feet (sq ft) development right by Jurong Lake Gardens have agreed to a reserve price of $250 million, down from $320 million in March, "in view of current market conditions", Huttons Asia said in a statement.

The new price translates to a land rate of roughly S$969 per square foot per plot ratio, after taking into account an estimated differential premium and lease upgrading premium of some $140.8 million.

Owners at the 160-unit development could net between $1.44 million and $1.6 million should the sale go through.

The residential site has an allowable gross plot ratio of 2.1. That means it could yield up to 440 dwelling units based on an average unit size of 915 sq ft, considering the new development control guidelines on the maximum number of units for private housing developments outside the central area.

8 March 2018

Meanwhile, owners at Park View Mansions are expecting $320 million in their collective sale attempt.

That translates to $1,183 psf ppr, inclusive of $157 million to intensify the land and to top up to a fresh 99-year lease, marketer Huttons Asia said.

Park View Mansions has a land area of 191,974 sq ft, with an allowable gross plot ratio of 2.1. The site can yield about 403,145 sq ft of GFA upon redevelopment.