URA said future residents at all 3 sites will enjoy direct access via public transport to Woodlands Regional Centre, the Central Business District and various parts of Singapore

THREE 99-year leasehold residential sites in the Upper Thomson area have come up for sale under the Government Land Sales (GLS) Programme for the first half of 2022, the Urban Redevelopment Authority (URA) announced on Tuesday (May 17).

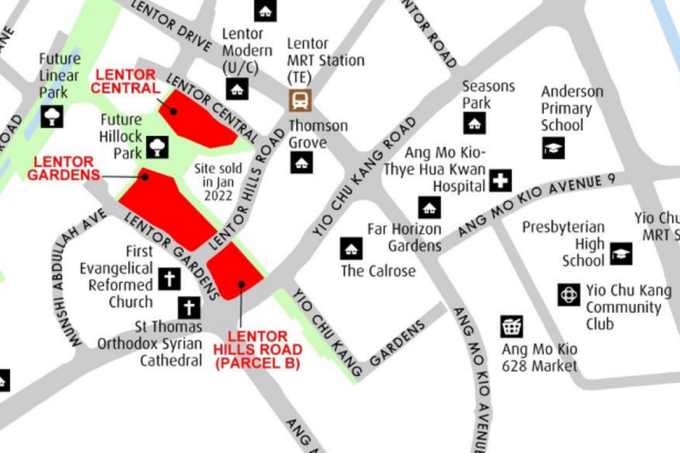

The sale of Lentor Central, Lentor Gardens, and Lentor Hills Road (Parcel B) plots within the new Lentor Hills Estate is expected to see healthy interest from developers with careful bidding.

Two of the 3 parcels - Lentor Central and Lentor Hills Road (Parcel B) - come under the government’s confirmed list and can yield about 735 housing units. The remaining plot at Lentor Gardens, which can yield 530 units, is on the reserve list and will be put up for tender only when a developer has indicated a minimum price which is accepted by the government.

Lentor Central spans a site area of 13,443.3 square metres (sq m) with a maximum gross floor area (GFA) of 40,333 sq m. Maximum building height for the site is 112 metres SHD (Singapore height datum) or 23 storeys, which can potentially yield 470 housing units. The Lentor Hills Road (Parcel B) site has an area of 10,819 sq m with a maximum GFA of 22,720 sq m. With maximum building height of 120 metres SHD, 8 storeys and 19 storeys may be built within the low-rise and high-rise zones, respectively, to yield about 265 housing units in total.

The Lentor Garden plot, with site area of 21,866.7 sq m and maximum GFA of 45,921 sq m, can potentially yield 530 units across a maximum building height of 120 metres SHD. Eight storeys may be built in the low-rise zone, and 16 storeys within the mid-rise zone.

Real estate agency Huttons Group foresees “lukewarm” developer interest in Lentor Central and Lentor Hills Road (Parcel B) despite a need to replenish their land bank. “In the face of increased risks from the cooling measures and rising construction costs, developers may not want to buy land in an area where there is ample supply. Interest may turn to either the Pine Grove (Parcel A) site or the en bloc market,” explained Huttons’ senior director of research Lee Sze Teck.

Lee estimates the 2 new sites to see between 3 and 5 bidders, with the top bid between S$1,000 and S$1,050 per square foot per plot ratio (psf ppr) to hedge against risks.

Nicholas Mak, head of research & consultancy at ERA Realty Network, noted that the last GLS land parcel sold in the area - at Lentor Hills Road - went to Hong Leong Holdings, Guocoland and TID Residential Pte Ltd at $1,060 psf ppr. The site was awarded in January this year a few weeks after a new round of cooling measures was introduced in December 2021.

Mak sees the top bid for the Lentor Central site coming in at $499 million to $550 million ($1,149 to $1,267 psf ppr), while the top bid for the Lentor Hills Road (Parcel B) site could be between $255 million and $289 million ($1,043 and $1,182 psf ppr).

PropNex Realty’s head of research and content Wong Siew Ying believes developers will remain mindful of the 2 other nearby plots that were sold recently and therefore be “more judicious with their bids”. She expects the top bids for both sites to range up to S$1,100 psf ppr.

Noting a lack of upgrading opportunities and few private condominiums in the area, OrangeTee & Tie’s chief executive Steven Tan expects strong demand for the completed units. He expects the 2 confirmed list sites to receive “healthy” bids, while noting that supply in the area could increase with more land parcels slated for release in the future.

“Thus, we expect the selling price to be between S$1,000 and S$1,100 psf ppr for each site, and between 7 and 10 bidders for each plot. This translates to a final bid price of S$434.1 million to S$477.6 million for Lentor Central, and S$244.6 million to S$269 million for Lentor Hills Road (Parcel B),” said Tan.

ERA’s Mak pointed to the “very limited supply of new private homes around the area”. The nearest comparable new launch is JadeScape at Shunfu Road, he said, which was marketed in 2018 and is coming up on the former HUDC Shunfu Ville site. “As at February 2022, only 1 per cent of the total number of units in JadeScape are left unsold.” Units at JadeScape, which has a total of 1,200 units, transacted in the first quarter of 2022 at a median S$1,790 psf.

Schools in the vicinity of the Lentor Hills sites include Presbyterian High School, Anderson Primary School, and CHIJ St Nicholas Girls’ School. Also coming up nearby is Guocoland’s mixed-use development Lentor Modern, which will be integrated with Lentor MRT station and will comprise 600 residential units and more than 96,000 sq ft of commercial, F&B and retail space.

The tender for the Lentor parcels will close on Sep 13, 2022, together with the tender for the HDB (Housing Development Board) executive condominium site at Bukit Batok West Avenue 5, to launched in June 2022.