NOTWITHSTANDING the cloud of uncertainty induced by the Covid-19 pandemic, the primary residential market has seen strong interest from homebuyers and investors, buoyed by positive sentiment, abundant liquidity, and low interest rates.

The disconnect between the strength of the property market and the health of the economy has stirred concern among policymakers who have long advocated for a sustainable property market. A prudent investment strategy should encompass an adequate horizon and take account of the structural growth factors to improve the odds favourably.

The latest Master Plan 2019 offers a glimpse into the future of our nation when it comes to new housing options and economic gateways. For instance, there is an emphasis on sustainable, green precincts which are community-centric and car-lite. A variety of public spaces and amenities can also help promote self-contained towns, while greenery and heritage aspects will be enhanced to preserve our cultural identity and ecosystems.

Changing demographics are also forcing planners to consider flexible facilities such as childcare centres, polyclinics and elder-care centres that can evolve in accordance with the needs of the local community.

The government's economic decentralisation drive is clear from the Master Plan, with no less than three major economic gateways being envisioned to bring employment opportunities closer to residential areas and contain congestion. The gateways are anchored by various economic clusters which will help promote economic agglomeration benefits and infuse a unique identity.

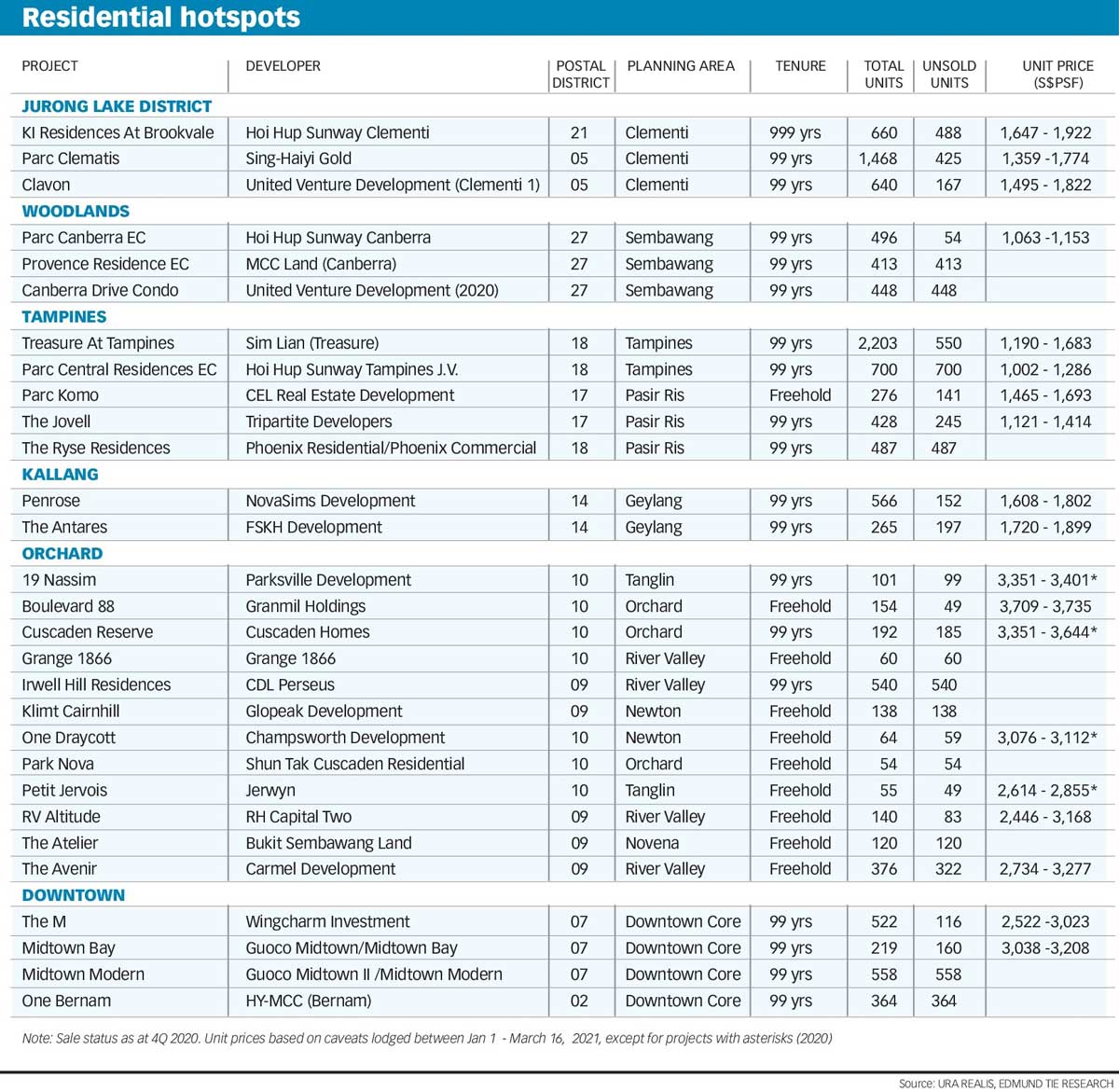

In this article, we outline a few residential hotspots that could prove to be winners for the patient investor.

JURONG LAKE DISTRICT

Envisioned to be the second central business district (CBD), the 360-hectare Jurong Lake District (JLD) is planned to be a mixed-use business district outside the city centre with quality offices, housing, amenities, leisure, and recreational facilities, leveraging on the area's unique lakeside and garden setting. Accessibility to the rest of the island will be enhanced with the Jurong Region Line scheduled to open by around 2027, and the Cross Island Line by 2035.

The area is also poised to benefit from the creation of the Jurong Innovation District (JID), an industrial district for advanced manufacturing. Opening in phases from 2022, this car-lite development will boast of Singapore's first car-free sky corridor spanning 11km designed for pedestrians, cyclists and autonomous shuttles. The consolidation of port operations at the Tuas Mega Port will also create more employment opportunities and buoy property demand.

A stone's throw away lies Tengah, Singapore's first smart and sustainable town equipped with smart technologies and green features. Another major feature is the 100m-wide, 5km-long Forest Corridor, which forms part of a larger ecological pathway connecting the Western and Central Catchment Areas. Home-owners in Tengah are likely to look towards the nearest growth centre, JLD, for home upgrading opportunities after serving out their minimum occupation periods (MOPs).

While there are no current launches in the JLD, projects such as Parc Clematis and Clavon have seen positive reception from the market as investors buy into the growth potential of the JLD.

WOODLANDS

Woodlands Regional Centre will be the largest economic hub in the northern part of Singapore to be developed over the next 15 years. It is also part of the Northern Agri-Tech and Food Corridor, which will house the JTC Food Hub @ Senoko. Food security concerns accentuated by the pandemic will undoubtedly support the growth of the agri-technology industry. In the town centre, Woods Square was completed last year and rejuvenated the commercial stock with over 500,000 square feet (sq ft) of quality office space, while the upcoming North Coast Building 1 will offer over 300,000 sq ft of industrial space. Woodlands Health Campus, which comprises both acute and community hospitals, a nursing home and specialist clinics, will open progressively from 2023, offering quality care to residents.

When the Thomson-East Coast Line is completed in 2024, it will take just 40 minutes to travel to the CBD, and just 30 minutes and 20 minutes to reach Orchard and JLD respectively. The Johor Bahru-Singapore Rapid Transit System (RTS) Link at Woodlands North Station is also scheduled to commence passenger service by end-2026, and the region will likely benefit from the increased passenger traffic.

The upcoming North-South Corridor is Singapore's first integrated transport corridor and promises to dramatically reduce travel times between Woodlands and the city centre by 2026. The connectivity enhancements are likely to narrow the differential between home prices in the north and that of prime homes.

Projects that could benefit from the growth of the Woodlands Regional Centre include Parc Canberra Executive Condominium (EC), Provence Residence EC, and the Canberra Drive development located in neighbouring Sembawang.

TAMPINES

Tampines is a mature housing estate and a first mover in several aspects. As the first of three regional commercial centres, it has a concentration of commercial stock with no less than three shopping malls in the town centre. It is also the first cycling town with plans in place to triple the length of the cycling network by 2022 to promote a car-lite experience. It also boasts Singapore's largest integrated community and lifestyle hub Our Tampines Hub, offering sports facilities, retail shops, as well as a library, community club and hawker centre.

The town benefits from its proximity to the Changi Business Park and Changi Airport. The eventual resumption of construction of Changi Airport Terminal 5, coupled with the planned Changi East Urban District, is expected to provide new sources of employment and home buying and renting demand. Other new employment nodes in the pipeline include new developments in the Pasir Ris Wafer Fab Park and Punggol Digital District. The latter is earmarked as Singapore's Silicon Valley and will support the nation's digitalisation drive.

Two new housing precincts, Tampines North and Tampines South, are being planned. We expect these precincts to rejuvenate the town with young residents and underpin upgrading property demand over time. Projects launched in the area include Treasure at Tampines and Parc Central Residences EC. The former has seen a 75 per cent take-up rate out of a total 2,203 units.

There are also two projects launched in Pasir Ris with encouraging response, and strong interest is expected for The Ryse Residences located near the Pasir Ris Mass Rapid Transit (MRT) station when it is launched later.

KALLANG

Traditionally perceived as Singapore's sports precinct, Kallang could be set for a revival. There are plans to transform Kallang into a lifestyle hub with an upgraded Kallang Riverside Park and with more sporting and community facilities at Kallang Alive! Sports Hub area, including a new iconic circular walking and cycling Kallang Alive Loop.

Located at the mouth of the Kallang River, Kampong Bugis is envisioned as a new attractive waterfront residential and recreational precinct that supports active mobility, environmental sustainability and fosters community interaction. A white site is currently placed on the Reserve List of the Government Land Sales (GLS) programme. If triggered and sold, the eventual development could offer up to 4,000 residential units and offer over 500,000 sq ft of complementary uses such as office, retail, serviced apartments community.

Further north, the expansion of Defu Industrial Park will offer two million square metres (sq m) of industrial space for the logistics, precision engineering, information and media, electronics, clean energy, and biomedical industries. With the relocation of Paya Lebar Airbase from 2030, 800ha of former military land could be redeveloped for higher yielding purpose in the form of a new town. Our bet is on the fast-selling Penrose development located at Sims Drive, which is poised to benefit from the growth of the Kallang and Paya Lebar clusters over time.

ORCHARD

Prime area living may have lost some allure as the pandemic accelerates economic decentralisation activities. However, we are cautiously optimistic that interest will pick up strongly should Singapore's premier Orchard shopping belt regain the sparkle of its earlier glory days. There are no easy solutions, but the Master Plan has shed light on rejuvenating Orchard Road as a lifestyle destination. Four precincts - Tanglin, Orchard, Somerset, and Dhoby Ghaut - will each offer a unique proposition targeted at various segments. For instance, Tanglin is envisioned as an arts precinct, Orchard as a shopping paradise, Somerset as a youthful and energetic entertainment spot, while Dhoby Ghaut will offer lush green spaces with family-friendly attractions.

Innovative retail concepts, attractions, entertainment, and events will be curated, and we may potentially see new mixed developments, elevated link bridges, more street activities, outdoor playgrounds and pedestrianisation as some of the many possibilities of what the future Orchard Road will look like. The current pandemic may have dampened foreigner interest, but we expect demand to swiftly return upon the eventual stabilisation of the pandemic. Investors are spoilt for choice, as there are numerous projects located in Orchard or a stone's throw away in the River Valley and Newton precincts.

DOWNTOWN LIVING

Over the years, the Downtown Core planning area has transformed from an office-dominated business district to a 24/7 lifestyle destination comprising residential and retail uses, and supported by vibrant dining, entertainment, and recreation options. We expect the downtown area to become increasingly more vibrant with delightful streets and public spaces that celebrate its rich cultural, heritage and green assets. We see three distinct waves of transformation in the business district.

The first wave started with the development of the Marina Bay Financial Centre (MBFC) a decade ago, followed shortly by the Asia Square development and, subsequently, Marina One. Residents of the area enjoy proximity to workplaces, retail offerings from By The Bay below MBFC and The Heart at Marina One, and easy access to green spaces such as The Lawn @ Marina Bay and Gardens by The Bay. Proactive placemaking efforts have strengthened its distinctive identity of Marina Bay, energising the public promenade and drawing people in with numerous interesting activities.

The second wave was arguably completed with the completion of Singapore's tallest building, the 290m Guoco Tower atop Tanjong Pagar MRT station in 2016. The development offers quality office space, luxury residences and a hotel component, complementing the multiple hotels in the vicinity and adding to the residential catchment that has grown through the years. A seamless connection between Tanjong Pagar and the traditional Raffles Place business precinct is envisaged by 2040 as Robinson Road is transformed into a transit-priority corridor (TPC) with existing car lanes being converted to bus lanes, cycling paths and wider pedestrian walkways. A new project One Bernam is expected to add to the vibrancy in the Tanjong Pagar area.

The rejuvenation of Bugis began when premium developments such as South Beach and DUO came on the scene in 2015 and 2017 respectively, offering premium commercial and living spaces. We are sanguine on the potential transformation for the area with the development of Guoco Midtown and the subsequent redevelopment of the former Shaw Towers.

The Bugis area will likely be transformed as these two developments increase connectivity and synergy between Marina Centre and the Bugis MRT station and surrounding heritage shophouses. Investors looking for units in new developments may consider the The M, Midtown Bay or the soon-to-be-launched Midtown Modern project.

OPPORTUNITIES ABOUND

A property purchase is a big-ticket item, and the wisdom of a purchase is often only realised upon hindsight. Owner occupiers and investors can remove some of the guesswork by questioning if there is a compelling growth story underpinning the location of their choice. From the allure of convenient city living to enjoying the glittering sights of Orchard Road at your doorstep to capitalising on the booming suburban centres, there are likely to be opportunities for every budget.

Reference: Residential hotspots: Districts shaping up to be interesting investment bets, The Business Times