3 June 2022

If you are in the market looking for a residential, commercial or industrial property, it is a good idea to first get to know the various forms of stamp duties that are involved in the purchase.

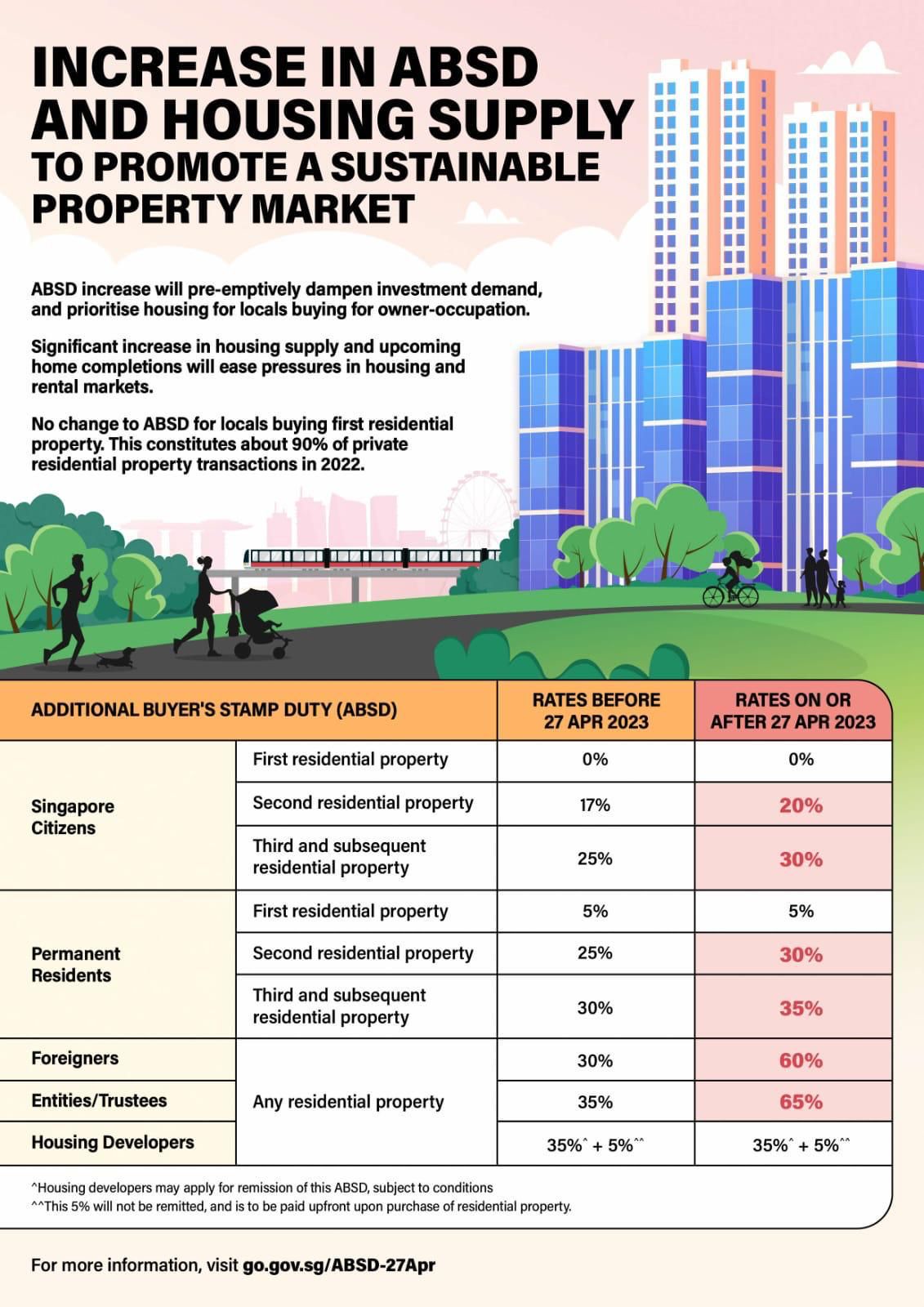

Stamp Duties are no small amounts - after the most recent round of changes implemented on 16 Dec 2021, Foreigners purchasing a residential property here in Singapore will incur an ABSD of 30%.

So it is definitely best for you to get to know the Stamp Duty rates first before you make a move.

Before 20 Feb 2018

Purchase Price or Market Value of the Property

On or after 20 Feb 2018

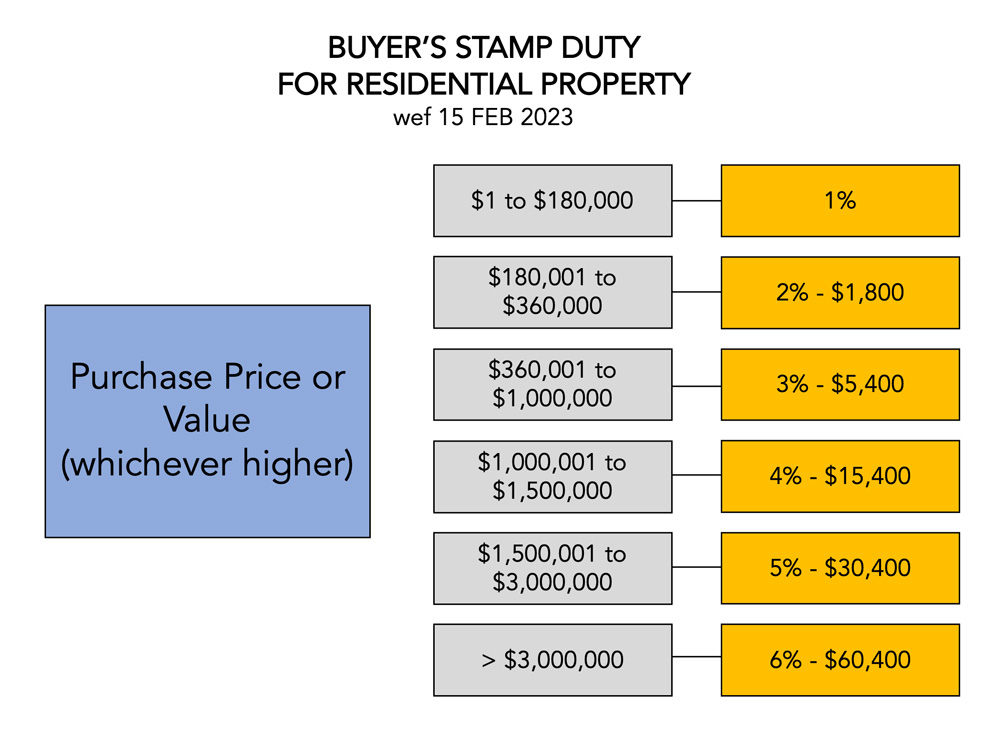

| Purchase Price or Market Value of the Property | BSD Rates for residential properties |

|---|---|

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining Amount | 4% |

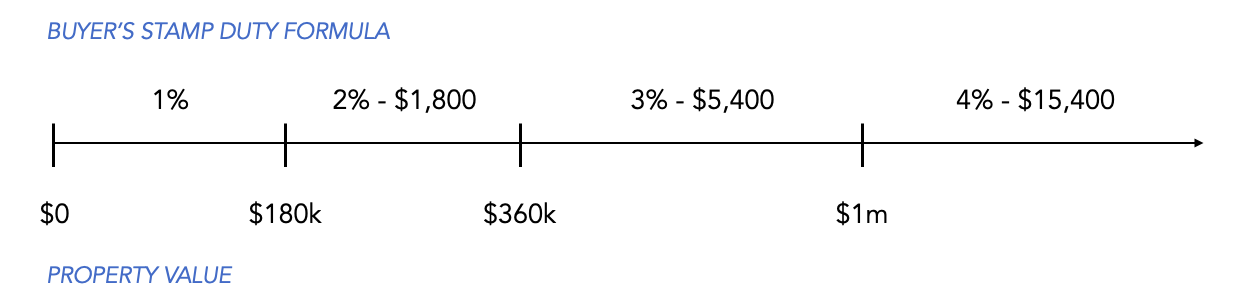

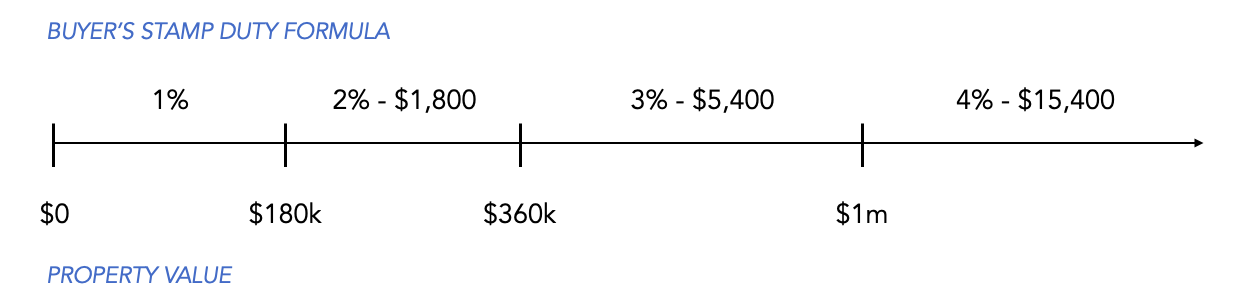

If the above table of rates is too complicated to remember, you can use this formula:

A married couple may be eligible for ABSD remission on the purchase of a residential property if the remission conditions under the Stamp Duties (Spouses) (Remission of ABSD) Rules are met.

Full ABSD remission may be applicable to a married couple who purchases a residential property jointly. The couple must include a Singapore Citizen (SC) spouse and the property must be purchased under both names of the couple only. In addition, both the spouses must not own any residential property.

(See : Remission of ABSD for a Married Couple)

ABSD remission may be applicable to a married couple who purchases a second residential property jointly, if the remission conditions are met. The couple must include a Singapore Citizen and the property must be purchased under both names of the couple only.

With effect from 27 Apr 2023, a 65 per cent ABSD (Trust) would be imposed on a transfer of a residential property into a living trust.

(See : ABSD, IRAS)

With effect from 27 Apr 2023:

(See : Remission of ABSD (Trust) , IRAS)

| Holding Period | SSD Rate (on the actual price or market value, whichever is higher) |

|---|---|

| Up to 1 year | 12% |

| More than 1 year and up to 2 years | 8% |

| More than 2 years and up to 3 years | 4% |

| More than 3 years | No SSD payable |

Goods and Services Tax or GST is a broad-based consumption tax levied on the import of goods (collected by Singapore Customs), as well as nearly all supplies of goods and services in Singapore. In other countries, GST is known as the Value-Added Tax or VAT.

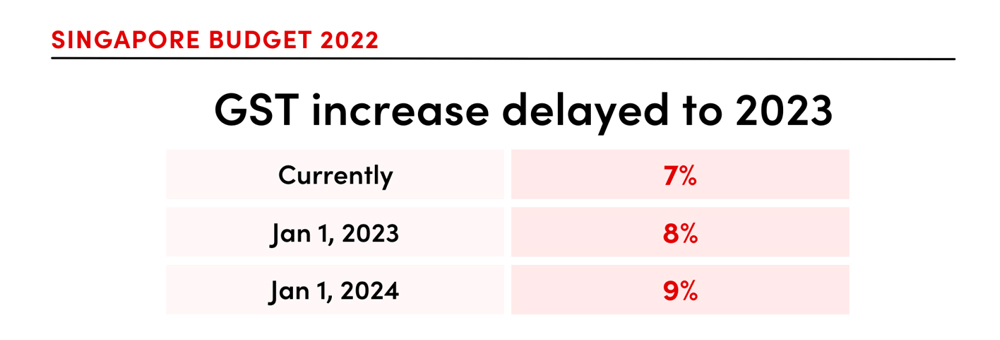

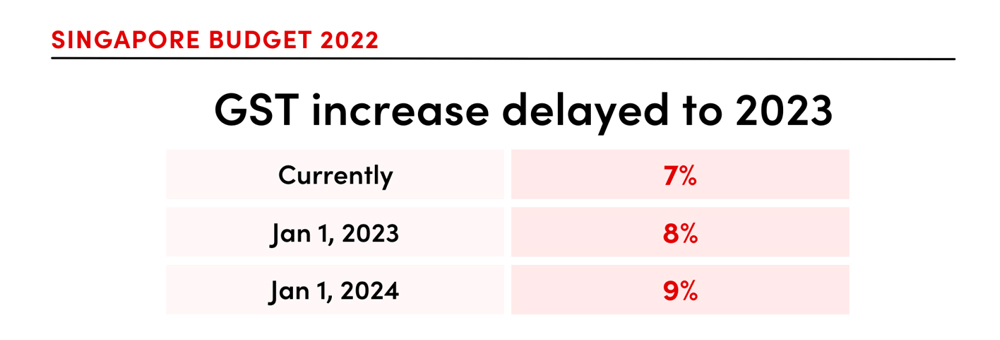

The GST is set to rise from 7 per cent to 8 per cent in 2023, and to further increase to 9 per cent in 2024.

(See : GST hike to proceed as planned to fund rising spending, says DPM Wong)

If purchase a commercial property with a company that is registered for GST, you can claim the GST incurred on business purchases (including imports) and expenses, as input tax in your GST return.

(See : Goods and Services Tax)

On or after 20 Feb 2018

| Purchase Price or Market Value of the Property | BSD Rates for residential properties |

|---|---|

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining Amount | 4% |

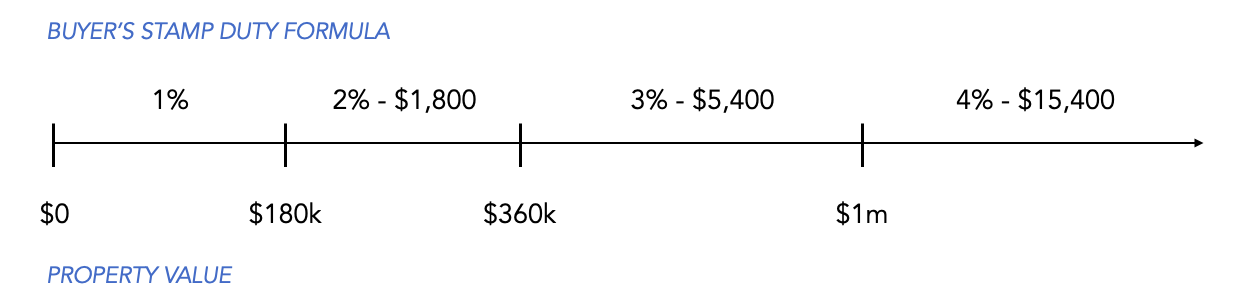

If the above table of rates is too complicated to remember, you can use this formula:

See : Definition of Industrial Property, IRAS

Goods and Services Tax or GST is a broad-based consumption tax levied on the import of goods (collected by Singapore Customs), as well as nearly all supplies of goods and services in Singapore. In other countries, GST is known as the Value-Added Tax or VAT.

The GST is set to rise from 7 per cent to 8 per cent in 2023, and to further increase to 9 per cent in 2024.

(See : GST hike to proceed as planned to fund rising spending, says DPM Wong)

If purchase a commercial property with a company that is registered for GST, you can claim the GST incurred on business purchases (including imports) and expenses, as input tax in your GST return.

(See : Goods and Services Tax)

On or after 20 Feb 2018

| Purchase Price or Market Value of the Property | BSD Rates for residential properties |

|---|---|

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining Amount | 4% |

If the above table of rates is too complicated to remember, you can use this formula:

| Holding Period | SSD Rate (on the actual price or market value, whichever is higher) |

|---|---|

| Up to 1 year | 15% |

| More than 1 year and up to 2 years | 10% |

| More than 2 years and up to 3 years | 5% |

| More than 3 years | No SSD payable |

A mortgage is a document where the interest in property is transferred from the borrower to the lender to secure the payment or repayment of money.

| Document | From 22 Feb 2014 |

|---|---|

| Mortgage | 0.4% of the loan amount granted on the mortgage (subject to a maximum duty of $500) |

| Variation to Mortgage | 0.4% of the loan amount granted on the mortgage (subject to a maximum duty of $500) |

| Equitable Mortgage | 0.2% of the loan amount granted on the mortgage (subject to a maximum duty of $500) |

| Transfer, Assignment or Disposition of any Mortgage or Debenture | 0.2% of the amount transferred, assigned or disposed, inclusive of interest which is in arrears (subject to a maximum duty of $500) |

(See : Mortgage Stamp Duty)

Stamp Duty on leases is payable based on the contractual rental or the market rental, whichever is higher, at the Lease Duty rates.

| Average Annual Rent (AAR) | Lease Duty Rates |

|---|---|

| AAR does not exceed $1,000 | Exempted |

| AAR exceeds $1,000 : | |

| Lease period of 4 years or less | 0.4% of total rent for the period of the lease |

| Lease period of more than 4 years or for any indefinite term | 0.4% of 4 times the AAR for the period of the lease |

(See : Rental Stamp Duty)

To provide an overview for all the types of stamp duties we've covered so far, here's a summary table: