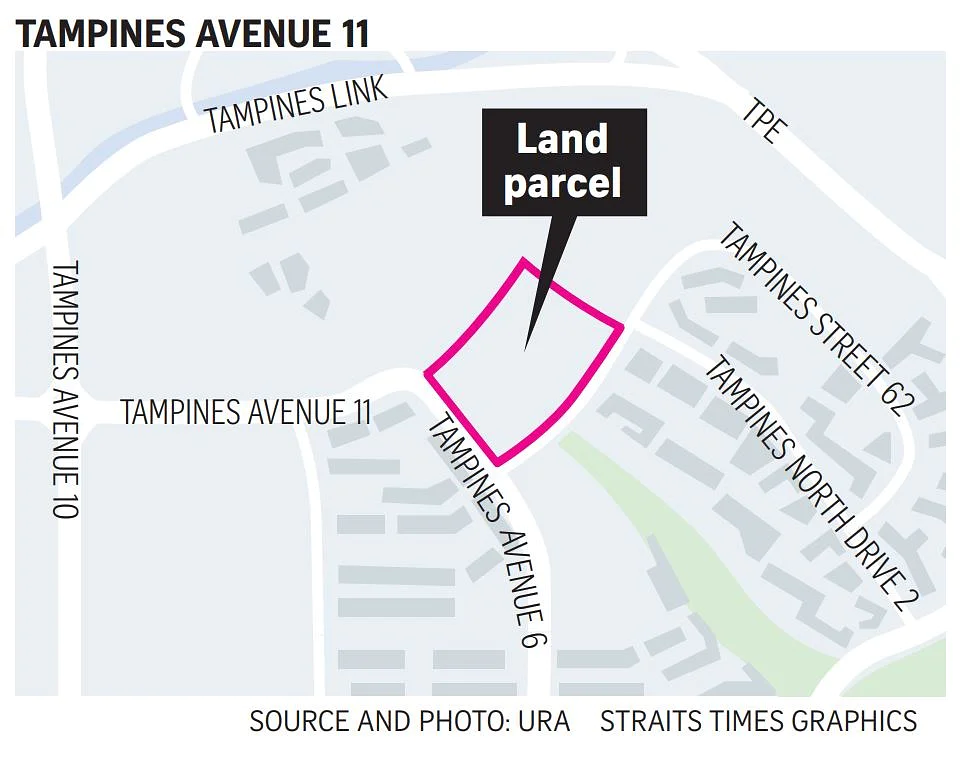

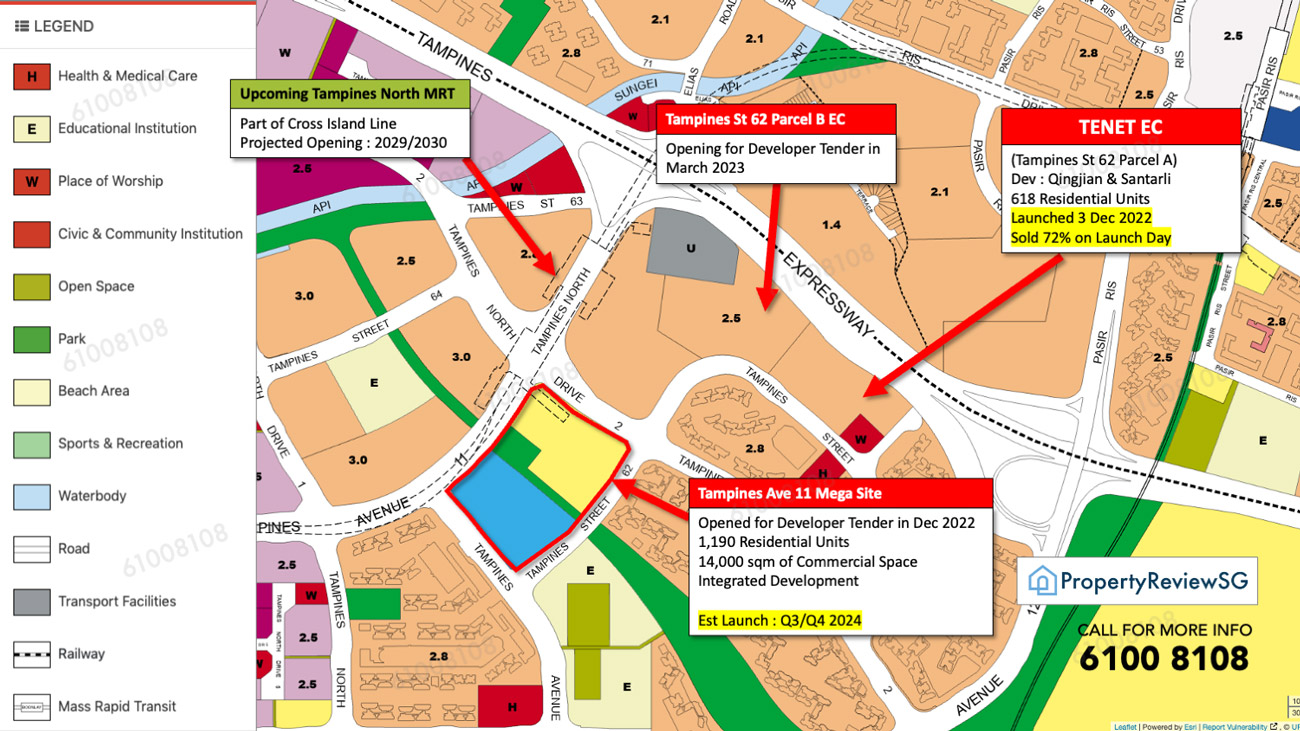

SINGAPORE - A 5.07ha mixed-use site in Tampines Avenue 11 is among the highlights of the latest government land sales (GLS) programme and will likely test developers' appetite for megasites, analysts say.

Potentially yielding 1,190 residential units and 14,000 sq m of commercial space, the site will be a significant development in the Tampines North area, providing private housing as well as amenities, Mr Ong Teck Hui, senior director of research and consultancy at JLL, said.

Large developers or consortiums looking for exposure in the suburban retail market may be interested.

As the site is located near the upcoming Tampines North MRT station, its retail component is sizeable and will likely attract footfall from many HDB projects there, Mr Wong Xian Yang, head of research at Cushman & Wakefield, said.

Mr Steven Tan, chief executive of OrangeTee & Tie, sees good interest, given the successful sales launch in 2019 of nearby Treasure at Tampines and pent-up demand from HDB upgraders.

But potential land costs of close to $1 billion could be a deterrent, given that the recent state tender closing for the Dunman Road megasite last week received a bit of a cold shoulder, Mr Ong said.

"But as the launch is expected to be in December this year, it remains to be seen if sentiment and demand for large sites could improve by then," he added.

Meanwhile, a white site in Woodlands Avenue 2 for a mixed-use development as well as a hotel in River Valley Road on the second-half reserve list have been carried over from the first-half reserve list.

Woodlands Avenue 2 is the sole white site on the reserve list after the removal of the Kampong Bugis white site, Knight Frank head of consultancy Alice Tan noted.

Despite developers' caution on large mixed-use sites, Ms Tan believes that "investment interest could return next year when new businesses emerge from the pandemic to become demand drivers", and when the pace of decentralisation of the Central Business District picks up.

Smaller sites in Bukit Timah Link and Hillview Rise should enjoy good demand due to their lower land costs, Mr Ong said.

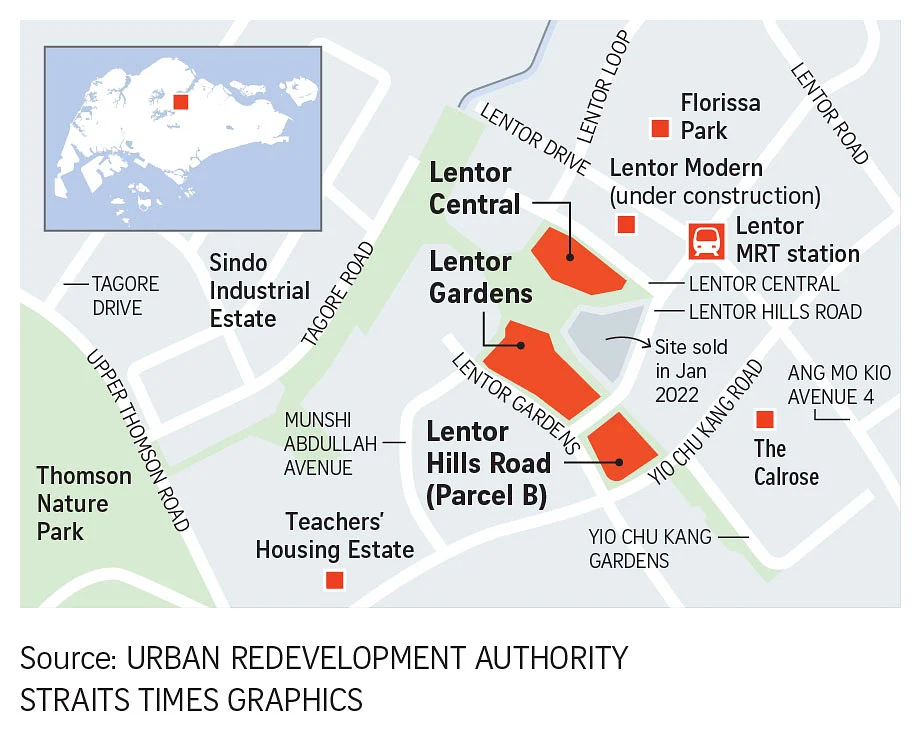

Ms Catherine He, Colliers' head of research in Singapore, said the sites in Hillview and Lentor Gardens should see strong demand from HDB upgraders.

She noted that the Lentor Gardens site is the fifth one released in the area, showing that Lentor is being developed into a private residential enclave.

She added: "Lentor Gardens and Marina Gardens Lane have space set aside for childcare centres, which highlights the Government's intention of making these estates conducive for young families."

The expected influx of new homes in the Lentor area will likely ensure land bids remain measured, Ms Wong Siew Ying, head of research and content at PropNex Realty, said.

"Slated for sale in October, we expect bidders for Lentor Gardens to take reference from the GLS tender results of the nearby Lentor Central and Lentor Hills Road (parcel B) sites, which will close on Sept 13," she noted.

The Bukit Timah Link site near the Beauty World MRT station could fetch a land price of below $200 million, while the Hillview Rise site near the Hillview MRT station could go for below $300 million, he added.

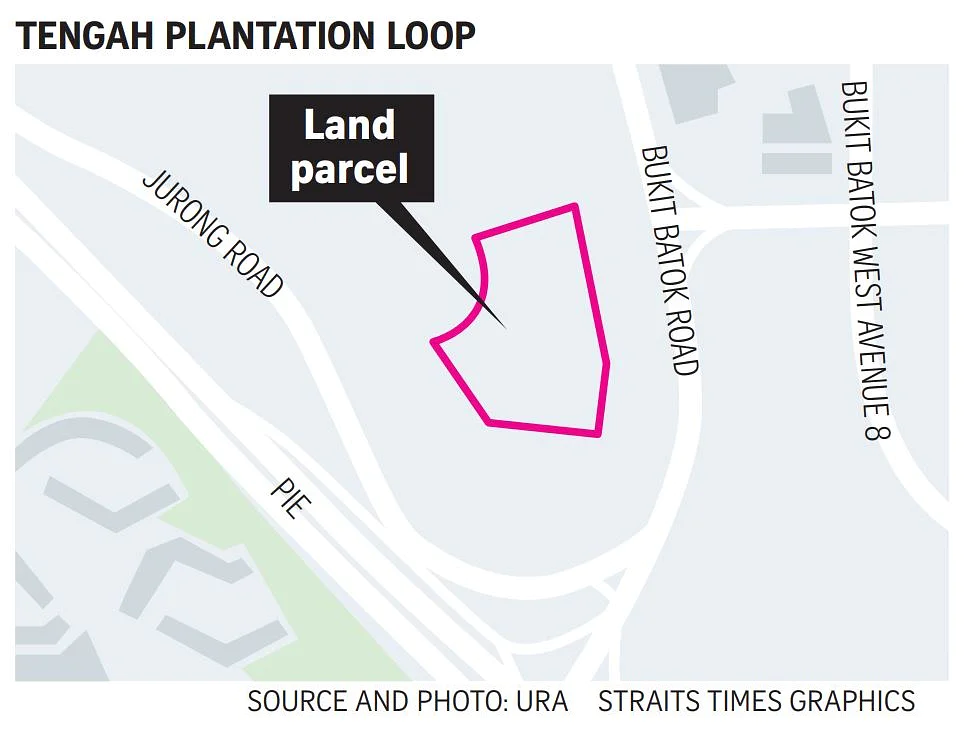

The Tengah Plantation Loop executive condominium (EC) site, which can yield 495 EC units, will complement public housing in the Tengah estate, she said.

It is one of four EC sites in the Tengah and Bukit Batok area, and bids for it may set a new record land rate for an EC GLS site, given its proximity to the Jurong Lake District, Ms Wong said.

With only three EC projects in the launch pipeline, the limited supply of ECs should spur stronger competition among bidders, Mr Ong said.

There were nine bids submitted for the nearby Bukit Batok West Avenue 8 site in March this year and seven bids for the Tengah Garden Walk site in May 2021, he said.

Read more about these Projects:

Land Pending Sale to Developer

Residential Units : Est 1,190

Commercial Space: 14,000 sqm

Land Sold : August 2021

Developer : Qingjian & Santarli

Residential Units : Est 590

Public Launch : Est Q4 2022

Land Pending Sale to Developer

Residential Units : Est 700