The Marina South site will comprise a mix of retail, office, hotel and residential uses

SINGAPORE - The supply of private homes under the Government Land Sales (GLS) programme for the second half of this year has been raised, in response to record-low unsold inventory, land-hungry developers and resilient demand.

Representing the fourth straight increase in the confirmed list supply, the number of private homes rose 25.9 per cent to 3,505 units from 2,785 units in the first half of the year.

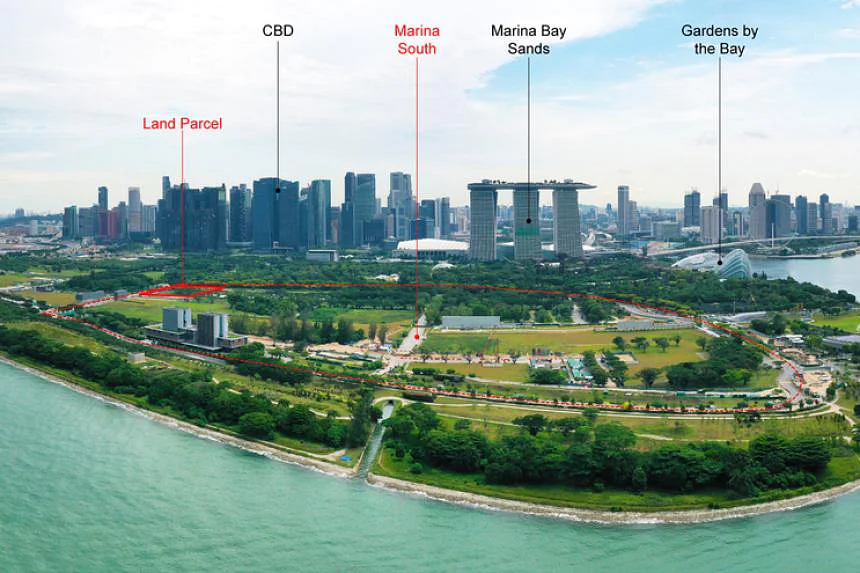

Among the sites announced by the Government on Tuesday (June 7) is the first site in Marina South - Marina Gardens Lane next to Gardens by the Bay. This site is set to kick-start development in the precinct.

While the supply of 3,505 units is the highest since the second half of 2014 when 3,915 units were released, some analysts call this a measured increase in view of the macroeconomic uncertainty, and expect that developers will continue to tap the collective sales market to boost their land bank.

In all, there are 14 sites under the GLS programme for the second half of this year - six confirmed list sites and eight reserve list sites.

This comes as unsold inventory hit a multi-year record low of 14,087 units as at the end of the first quarter and healthy sales at recent new launches Piccadilly Grand and Liv@MB.

Mr Wong Xian Yang, head of research at Cushman & Wakefield, noted that the Government has ramped up supply in the confirmed list to moderate private residential price growth and land prices.

"Forty-eight per cent of total supply will come from the confirmed list for the second half 2022 GLS programme, compared with 43 per cent in the first half this year, and 29 per cent in the second half of 2021," he said.

The 14 sites combined can yield about 7,310 private residential units, 94,750 sq m gross floor area (GFA) of commercial space and 530 hotel rooms.

On the confirmed list are five private residential sites, including one executive condominium (EC) site, and one commercial and residential site. These can yield 3,505 private residential units (including 495 EC units) and 14,750 sq m GFA of commercial space.

The reserve list comprises six private residential sites, including two EC sites, one white site and one hotel site in River Valley Road, which can yield an additional 3,805 private residential units (including 1,000 EC units), 80,000 sq m GFA of commercial space and 530 hotel rooms.

The reserve list will give developers a good selection of sites to initiate for development if there is demand. The increase is in keeping with the Government's promise to ramp up the supply of both private and public housing sites to maintain market stability in the wake of the December 2021 cooling measures.

But Mr Nicholas Mak, head of research and consultancy at ERA Real Estate, said there is insufficient supply to meet demand for ECs, which could fuel further price increases.

There are only 450 launched and unsold EC units in the primary market, he noted, adding that while there are three new EC launches in the pipeline, these will likely be spread over the next 18 months.

"This means that on average, developers will launch about two EC projects each year," he added.

Analysts said the Marina Gardens Lane site in Marina South - which can yield 795 residential units - would be the most popular.

"Developers who buy this site will have the first-mover advantage in the precinct's development as it is the first residential site out of five sites along the same stretch," Mr Steven Tan, chief executive of OrangeTee & Tie, said.

But the sizeable site and the potential huge outlay of more than $1 billion may attract only a handful of developers, Mr Lee Sze Teck, Huttons Asia's senior director for research, said.

Mr Wong said the site, located in the prime district, will "test developers' appetite for high-end private homes in the Central Business District".

The 45ha Marina South precinct, which overlooks the Marina Reservoir and the Singapore Strait, will comprise a mix of retail, office, hotel and residential uses. It can yield more than 10,000 homes, the Government said.

In the past two years, sites on the confirmed list have seen more activity than those on the reserve list, said Ms Alice Tan, head of consultancy at Knight Frank Singapore.

Only the Marina View white site - intended for a mixed-use development with residential, hotel, commercial and/or serviced apartments - was released last year under the reserve list of the first-half 2021 GLS programme, she noted.

But in the next six months, more developers may consider triggering reserve list sites, she added.

"But the sites they may trigger for release may be smaller ones, where 500 units or fewer can be built, as larger sites of more than 700 units are less appetising in view of the increase in the additional buyer's stamp duty to 35 per cent," Ms Tan said.