If you are looking to purchase a New Executive Condominium (EC), there are a number of eligibility criteria and also income assessment guidelines to be aware of.

In this article, we will cover the most frequently asked topics for buyers who are new to the guidelines of new ECs.

First, a quick overview on how EC Launches work.

EC Land Plots are sold by HDB, and information on currently available and upcoming land plots for Developers to bid on is made available on HDB's website at this link: HDB Government Land Sales and also the One Stop Developer's Portal.

Some EC Land Plots are first placed in the Reserve List, meaning that they are not released for tender immediately, but are made available for application instead. A site on the Reserve List will be put up for tender only when a developer has made a successful application, with a minimum price which is acceptable to the Government.

Some EC Land Plots will be placed directly on the Tender List, which allows Developers to submit an application to buy the Land Plot within a Tender Period specified by the authorities as part of the specifications of the Tender.

Once the Land Plot has been awarded to a Developer, there is a mandatory 15-month wait period, during which the Developer is not allowed to sell the units, nor market the project, or make available any project information such as Project Name, Floorplans, Pricing etc.

See here for more information: 15-month waiting time for EC launches stays: MND, The Straits Times, Jan 2016

During the 15-month wait period, the Developer will commence activities such as construct the showflat, work with their Architects/Brand Consultants to create the design concepts of the residential project.

Once the 15-month wait period is up, the Developer will commence the showflat Preview and typically also run a Press Release in the papers with starting prices/psf per unit categories ahead of the start of the Preview period.

See here for a video explainer on How EC Price Release Works

Please note that the Eligibility Criteria for buyers of a New EC are determined and set by HDB, hence do refer the guidelines at HDB Website for more information : HDB Executive Condominium Eligibility

The EC Eligibility Criteria are as follows:

(1) General Eligibility Criteria

| Criteria | Description |

| Citizenship | You are a Singapore Citizen. Your family nucleus must comprise at least another Singapore Permanent Resident or Singapore Citizen. |

| Age | 21 years old and above |

| Family Nucleus | Your household must comprise 1 of the following groups: • You and your fiancé or fiancée • You and your spouse, and child(ren) • You, your parents and siblings. If you are an unmarried/ widowed/ divorced Singapore Citizen (SC) buying an EC with parents, at least 1 of your parents must be a SC or Singapore Permanent Resident (SPR). • You and your child(ren) under your legal custody, care and control (for widowed/ divorced persons). If the care and control of your child is shared with your ex-spouse, you must obtain his/ her written agreement before you may list your child in an EC application. • You and your siblings who are orphans and single, i.e. unmarried, divorced or widowed persons@ may apply for an EC unit with the following criteria: • All your siblings are listed in the same application, and they are not applying for/ owning/ renting a flat separately. • At least 1 of your deceased parents was a SC or SPR. • You and up to 3 other singles as core applicants |

| Household Status | You and the essential family members listed in the application for purchase of the flat must not: • Be the owners of a flat bought direct from HDB, a DBSS flat or an Executive Condominium bought with CPF Housing Grant from the developer • Have sold a flat bought direct from HDB, a DBSS flat or an Executive Condominium bought with CPF Housing Grant from the developer • Have received the CPF Housing Grant for the purchase of an HDB resale flat • Have taken other forms of housing subsidy (for example, benefitted under the Selective En bloc Redevelopment Scheme, privatisation of HUDC estate etc) |

| Monthly household income ceiling | The total income of all persons listed in the EC application must not exceed $16,000. You will be guided by the property developer on the submission of documents, such as income documents, when you book an EC unit. |

| Wait-out period before applying to buy an EC unit from a property developer | Cancellation of application after booking a flat from HDB If you have booked a flat from HDB and subsequently cancel your flat booking, you must wait out a 1-year period from the date of the cancellation before you may apply or be listed as a core occupier to buy an EC unit from a property developer. Termination of the Sale and Purchase Agreement for an EC unit If you had previously bought an EC unit from a property developer with a CPF Housing Grant and subsequently terminated the Sale and Purchase Agreement, you must wait out a 5-year period from the date of the termination before you may apply or be listed as a core occupier to buy an EC unit from a property developer. Owners/ Ex-owners of an EC unit bought from a property developer If you currently own or have recently disposed of your ownership in an EC unit, you must wait out a 30-month period from the date of disposal of the EC unit before you may apply or be listed as a core occupier in an application to buy another EC unit from a property developer, subject to other eligibility conditions. |

(2) Household Family Nucleus

| Scheme | Family Nucleus |

| Public | You, the applicant and: – Your spouse, and children (if any) – Your parents, and siblings (if any) – Your children under your legal custody, care and control (for widowed/divorced) |

| Fiance/Fiancee | You, the applicant, and your fiance/fiancee (Marriage cert is required within 3 months of collecting keys to your unit) |

| Orphan | You, the applicant, and your unmarried siblings |

| Joint Singles Scheme | You, and up to 3 other co-applicants, and all of you are: – Single (unmarried, divorced or widowed) – Singapore Citizens – At least 35 years old – Applying jointly as co-applicants Please note that the CPF Housing Grant for singles is not available when buying an EC |

(3) Fulfil MOP Criteria

| Type of Property | Time Period Before You Can Apply for a New EC Unit |

| • HDB flat bought from HDB or on the open market • DBSS flat bought from the developer | MOP (Minimum Occupation Period) of 5 years |

| • EC unit bought from the developer | MOP of 5 years + 30 months from date of EC disposal |

Buyers who are interested to apply for a New EC will need to fill in an Application Form, that will cover information such as Buyers' Names, NRIC, work information, income for the assessment period, residential address, and whether they are first or second timers.

This information will help form part of the assessment of the eligibility of the buyers and will also allow Buyers to be given a Ballot Ticket to Ballot for the New EC.

Click here to see a sample EC Application Form.

To purchase a New EC, all applicants will have to submit their income documents for a period of 12 months, 2 months preceding the month of Application for the New EC.

For example, if the month of Application for a New EC is in June 2024, then the applicants will need to submit their payslips for the months of May 2023 to April 2024.

Do note that ALL components in the payslips ARE to be included for Income Assessment.

Only Bonus(es) are excluded. For eg, Reimbursement/Claims, Overtime, Director Fees are to be considered.

How the income is assessed is that monthly gross income values (along with relevant income components) are added up within the assessment period and divided by 12.

At this point of time of writing, the income ceiling is $16,000 (if your income exceeds $16,000, please contact us here)

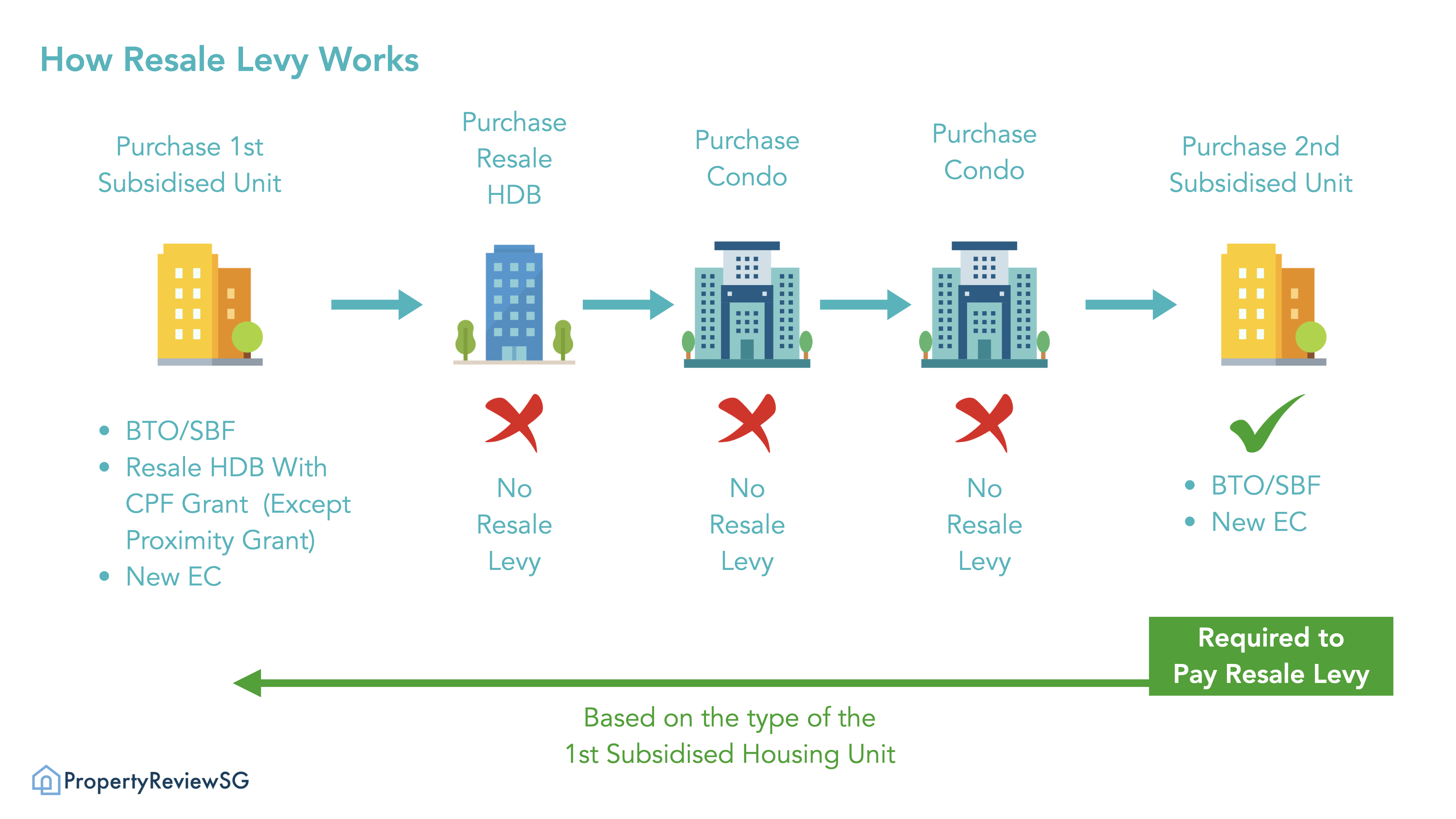

As part of the purchase process, buyers of a New EC may also be required to pay a Resale Levy.

The Resale Levy is only applicable for buyers who have previously enjoyed a housing subsidy before, i.e. they have purchased either a BTO/SBF directly from HDB, or purchased a Resale HDB and took a CPF Housing Grant (except if they took a Proximity Grant).

To be clear, when owners of a subsidised unit sells their unit away, they do not need to pay the Resale Levy. They can go on to purchase any other form of housing unit (where applicable) such as another Resale HDB or private residential units.

The Resale Levy is only payable when they wish to purchase the 2nd Subsidised Housing Unit, i.e. another BTO/SBF or a New EC.

In this case, the Resale Levy that is payable will be assessed based on the type of their first subsidised housing unit, not that the one that they intend to buy,

See this video for an explainer on how the Resale Levy works.

See the HDB Website for more details on the Resale Levy.

If the first subsidised flat was sold from 3 March 2006 onwards, buyers will pay a fixed amount of resale levy as follows:

| First Subsidised Housing Type | Resale Levy Amount | |

| Households | Single Grant recipients | |

| 2-room flat | $15,000 | $7,500 |

| 3-room flat | $30,000 | $15,000 |

| 4-room flat | $40,000 | $20,000 |

| 5-room flat | $45,000 | $22,500 |

| Executive Flat | $50,000 | $25,000 |

| Executive Condominium | $55,000 | Not applicable |

If the first subsidised flat was sold before 3 March 2006, a percentage graded resale levy will apply (see below table for more details).

If sellers had opted to defer the payment of the resale levy until you buy another flat from HDB, an interest at a prevailing rate of 5% per annum is charged.

| First Subsidised Housing Type | Resale Levy Amount | |

| Based on resale price of the sold flat, or 90% of its market valuation, whichever was higher | ||

| Households | Single Grant recipients | |

| 2-room flat | 10%* or 15% | 5%* or 7.5% |

| 3-room flat | 20% | 10% |

| 4-room flat | 22.5% | 11.25% |

| 5-room flat and Executive | 25% | 12.5% |

Applicants of a New EC may also apply for CPF Housing Grants; however the housing grants are only applicable for First Timers buyers. Second Timers are not eligible for Housing Grants.

The amount of Housing Grant for applicants is dependent on their combined income, as follows:

| Average Gross Monthly Household Income* | Family Grant | Half-Housing Grant# | |

| SC/SC Household | SC/SPR Household | ||

| $10,000 or lower | $30,000 | $20,000 | $15,000 |

| $10,001 to $11,000 | $20,000 | $10,000 | $10,000 |

| $11,001 to $12,000 | $10,000 | Nil | $5,000 |

| $12,001 to $16,000 | Nil | Nil | Nil |

The following policies are valid with effect from 9 May 2023.

Purchasers of a New EC can choose between 2 payment modes : the Normal Progressive Payment Scheme (NPS) and Deferred Payment Scheme (DPS).

The NPS payment structure will require payment from buyers as per each construction stage of the project, with the Developer calling for payment and buyers furnishing either Cash, CPF or Loan.

As for the DPS structure, it only requires that buyers pay the first 20% of the unit purchase price, along with the Buyer's Stamp Duty and Legal Fees. The next payment of 65% is only required at TOP.

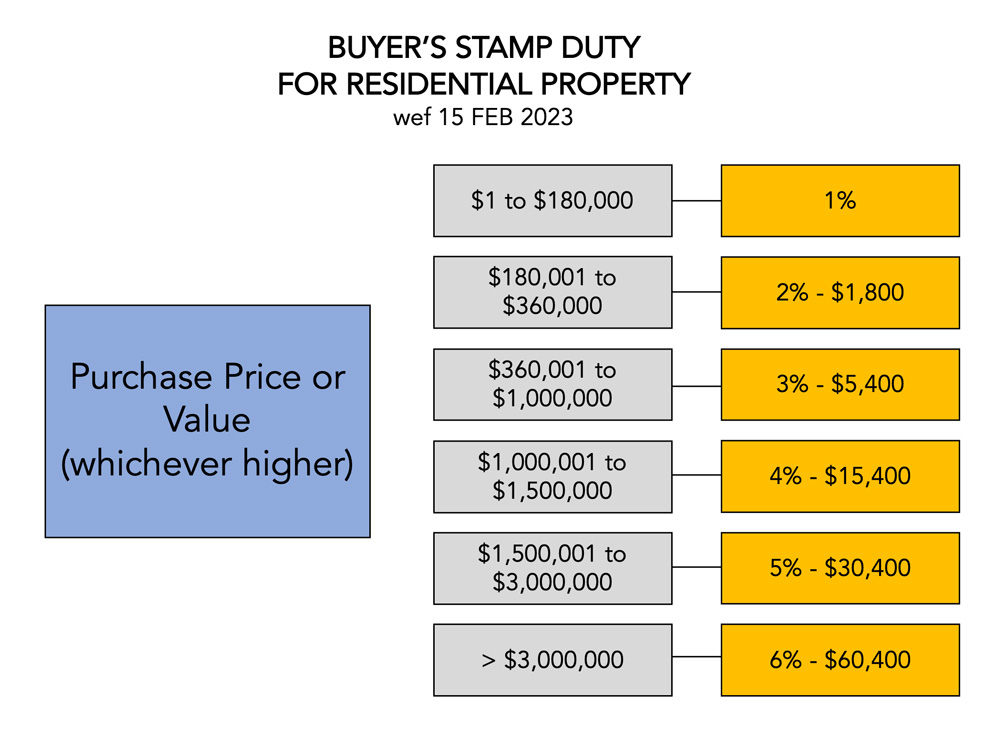

For buyers of a New EC (and also for all residential/commercial/industrial properties), it is required to pay Buyer's Stamp Duty (BSD) within 14 days of Exercising the OTP.

See : Buyer's Stamp Duty, IRAS

See : All About Stamp Duties

Refer to the following table for BSD rates based on the purchase price of the New EC.

Buyers of a New EC, even if they own a HDB at the point of purchasing the EC unit, will not have to pay Additional Buyer's Stamp Duty (ABSD).

This because buyers are required to sell their HDB within 6 months of the New EC reaching TOP (Temporary Occupation Permit).

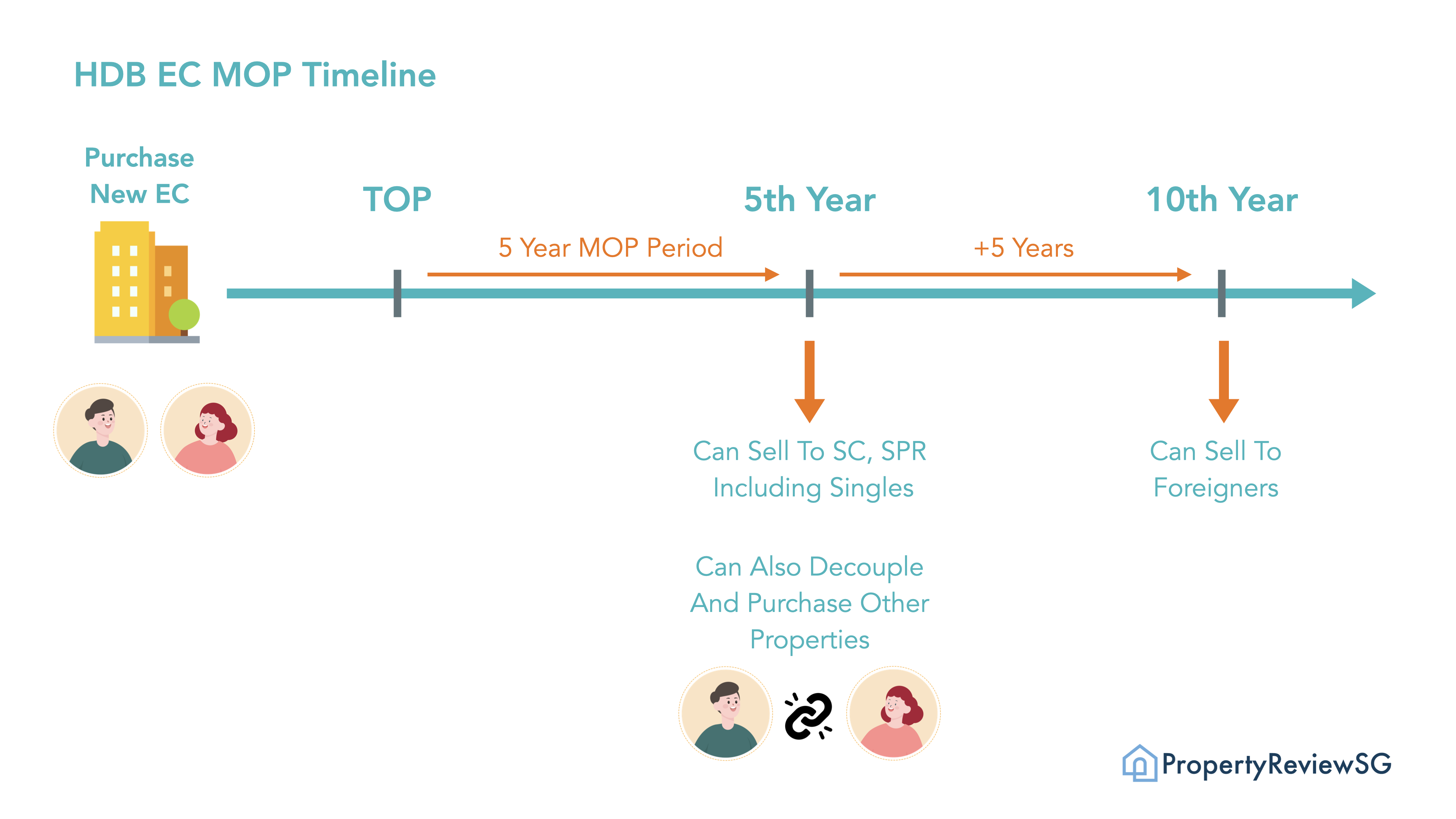

For all EC Projects, once the development has been issued a TOP (Temporary Occupation Permit) date, the MOP (Minimum Occupation Period) of 5 years will commence.

During the MOP Period, owners of the EC unit are not allowed to sell the unit (unless with explicit permission from HDB), and cannot rent out the whole unit; although they are allowed to rent out rooms.

Once the MOP Period has been met, the EC Project is semi-privatised, and the unit can then be sold in the open market to Singapore Citizens and Permanent Residents, including Singles.

At the same time, owners of the EC unit can also choose to decouple and allow one of the owners to purchase other residential properties without incurring ABSD.

See here for a video explainer on How Decoupling Works.

After a further 5 years from MOP, i.e. 10 years from the project TOP, the EC development becomes fully privatised and all units can be sold to Foreigners as well.

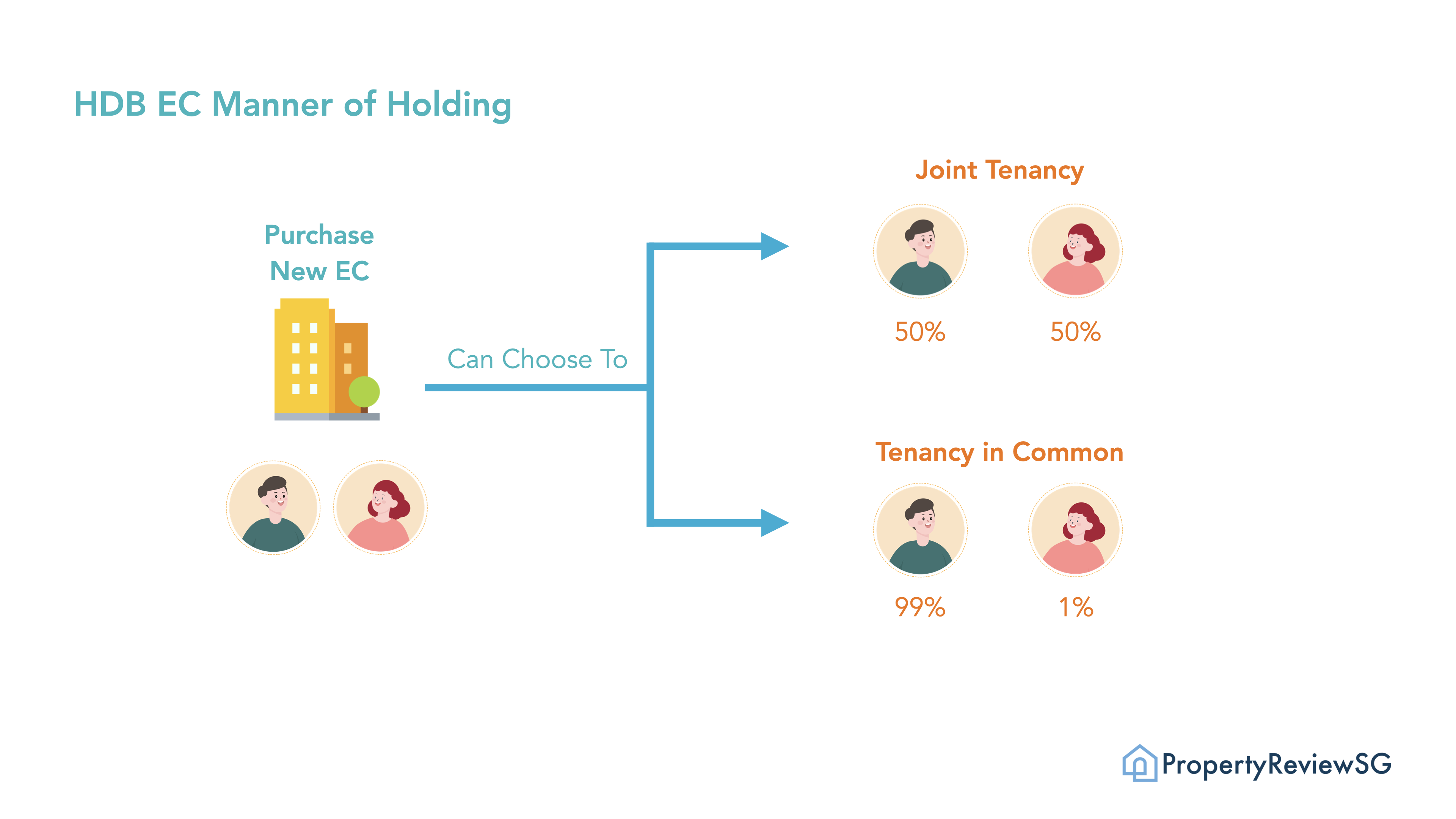

Purchasers of a New EC can choose their Manner of Holding when they are Exercising the Option To Purchase, typically done at a law firm.

The Manner of Holding can be Joint Tenancy, i.e. both owners will hold the unit in 50%-50% equal shares.

Alternatively, the owners can also choose Tenancy in Common, in which each owner is free to choose how much shares he/she will hold. One example would be to hold the property in 99%-1% share distribution, which will help reduce fees if the owners intend to Decouple their ownership in future.

Do note that the percentage of shares owned by each owner does not determine how much he/she can contribute towards the payment of the property.

See here for a video explainer on How Decoupling Works.