The long awaited Pasir Ris 8 eBrochure is ready!

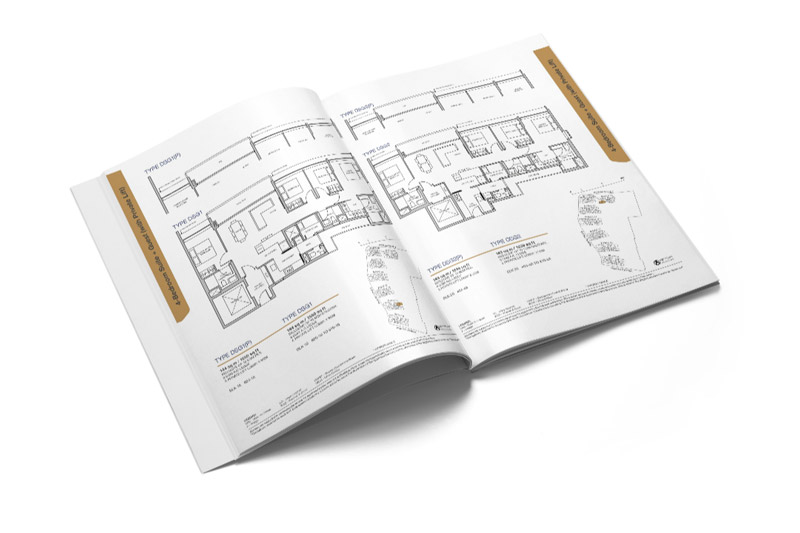

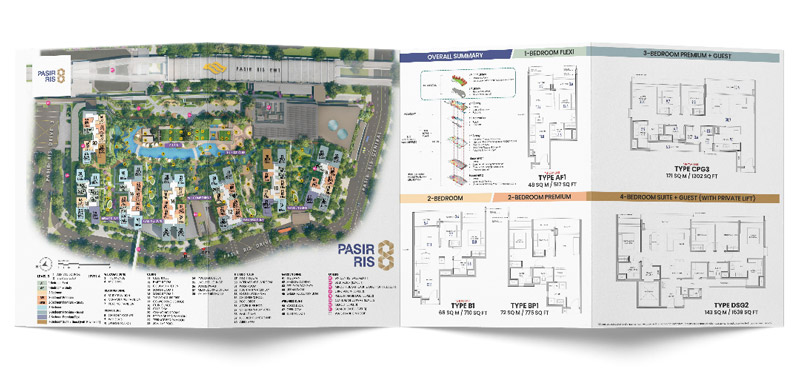

Download the full eBrochure to browse through a full set of artists' impressions, and all 18 pages of Floorplans, from 1Bedroom Flexi (517 sqft) to 4Bedroom Suite + Guest (1539 sqft with private lift).

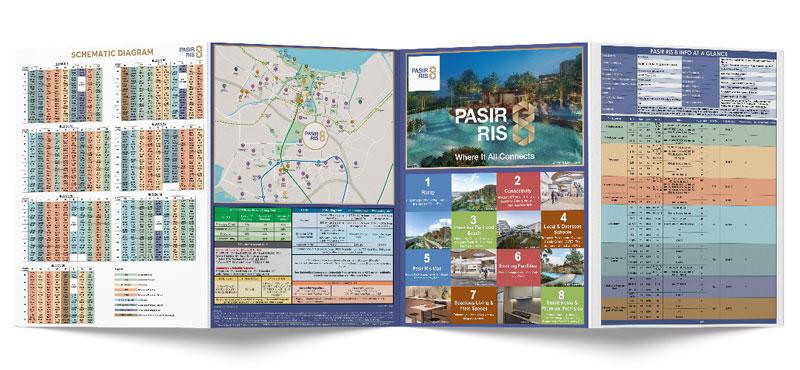

The high-resolution 4-Fold Brochure also provides a great overview of the development in a quick summary.

The Pasir Ris 8 showflat is located at the open air carpark opposite Downtown East.

Parking is available on site.

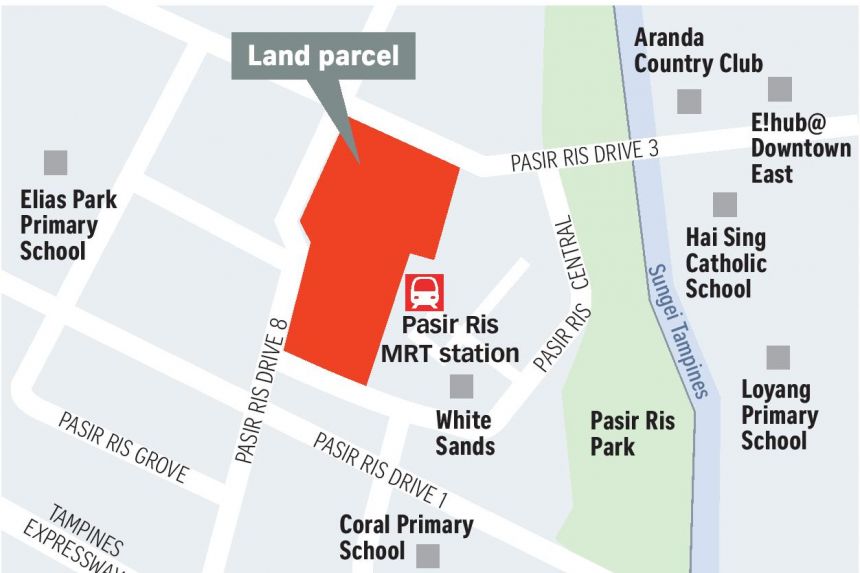

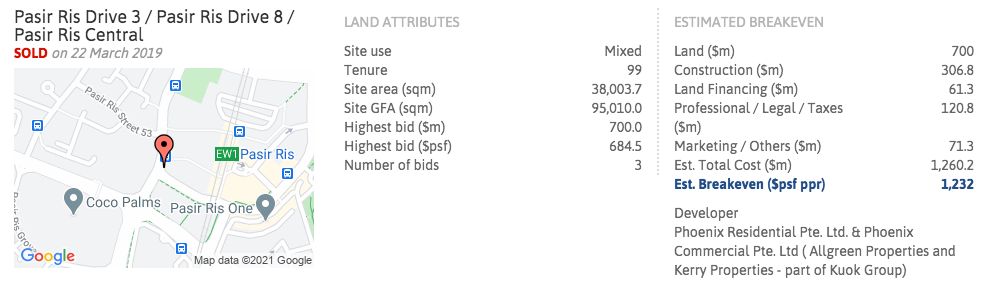

Pasir Ris is a white site next to Pasir Ris MRT Station, and was awarded via tender to Phoenix Residential Pte Ltd and Phoenix Commercial Pte Ltd. Both companies are owned by a joint venture between Allgreen Properties and Kerry Properties - the two companies are part of the Kuok Group of Companies controlled by Malaysian tycoon Robert Kuok.

Their winning bid is nearly $700 million, which works out to $684.48 per square foot per plot ratio (psf ppr) based on the total gross floor area of 1.02 million sq ft.

The dual envelope concept and price revenue tender for the 99-year leasehold plot closed on Dec 14, 2018, attracting three bids.

The only other shortlisted tenderer, Laguna Garden and Far East Commercial Trustee - both units of Far East Organization - bid nearly $677.78 million, translating to $662.75 psf ppr.

There was a third bidder that took part in the tender but was not shortlisted - a tie-up between Singapore Press Holdings and Kajima Development.

The successful land bid by Phoenix Residential Pte Ltd and Phoenix Commercial Pte Ltd works out to be $684.48 per square foot per plot ratio (psf ppr) based on the total gross floor area of 1.02 million sq ft.

The breakeven price is estimated at $1232 psf.

The Kuok Group real estate arm in Singapore is Allgreen Properties Limited. Incorporated in 1986, Allgreen was listed on the Singapore Stock Exchange in May 1999 and was then majority owned by the Kuok group. It was delisted in August 2011 from the Singapore Stock Exchange following its compulsory acquisition by Brookvale Investments Pte Ltd (which is itself part of the Kuok group of companies).

Today, Allgreen is one of the largest property groups in Singapore reputed for its quality products and track record of strong take-up rate for its projects. As at 31 December 2014, the Allgreen group has 35 subsidiaries and 13 associated companies. Although Allgreen began operations in 1986, the history and track record of Allgreen’s property-related businesses can be traced back to the times when it started as a division of Kuok (Singapore) Limited in early 1980.

Kerry Properties Limited ("Kerry Properties"), incorporated in Bermuda with limited liability, was listed on The Stock Exchange of Hong Kong Limited (Stock code 683) in 1996. Subsidiaries of Kerry Properties (which together with Kerry Properties referred to as the “Group”) have been involved in property investment and development activities in Hong Kong since 1978.

As a world-class property company with significant investments in Mainland China and Hong Kong, Kerry Properties is also selected as a constituent stock in the Hang Seng Composite Index, Hang Seng Composite LargeCap Index, Hang Seng Composite Industry Index (Properties & Construction) , Hang Seng Corporate Sustainability Index, Hang Seng (Mainland and HK) Corporate Sustainability Index and Hang Seng Corporate Sustainability Benchmark Index.

| Item | Description |

|---|---|

| Developer | Phoenix Residential Pte Ltd and Phoenix Commercial Pte Ltd (Allgreen Properties and Kerry Properties) |

| Address | 08, 10, 12, 14, 16, 18, 20 Pasir Ris Drive 8 |

| Project Description | Proposed mixed use development comprising 2 basements for carpark and commercial use, with underground linkway, a 4 storey podium comprising bus interchange, HDB town plaza, polyclinic and 7 blocks of 10 11 storey residential flats (Total 487 units) with ancillary facilities on lot 03235 K MK 29 AT Pasir Ris Drive 3 Pasir Ris Drive 8 Pasir Central (Pasir Ris Planning area) |

| District | District 18 |

| No. of units | 487 residential units |

| Tenure of Land | 99 years with effect from July 2021 (Actual date TBA) |

| Expected Vacant Possession | TBA |

| Expected Legal Completion | TBA |

| Site Area | 38,003sqm |

| Plot Ratio | 2.5m |

| Carpark Lots | TBA |

| Show Units Type | 1BR | 2BR | 3BR PREMIUM |

| Architect | DCA Architect Pte Ltd |

| Landscape Architect | SHMA Company Limited |

| Project Interior ID | 1BR & 2BR (SuMisura) 3BR (Cynosure) |

| M&E Engineer | J Roger Preston (s) Pte Ltd |

| C&E Engineer | Mott Macdonald Singapore Pte Ltd |

| Quantity Surveyor | Threesixty Cost Management Pte Ltd |

| Main Contractor | Woh Hup (Private) Limited |

| Bedroom Type | Size (sqm) | Size (sqft) | No. of Units |

|---|---|---|---|

| 1-Bedroom | 48-50 | 517-538 | 92 |

| 2-Bedroom | 66-77 | 710-829 | 219 |

| 3-Bedroom | 95-121 | 1023-1302 | 146 |

| 4-Bedroom | 136-144 | 1464-1550 | 30 |

| Total 487 Units |