SINGAPORE - Inflation rates have been climbing globally but they vary widely - from around 2 per cent in some countries to more than 10 per cent in others.

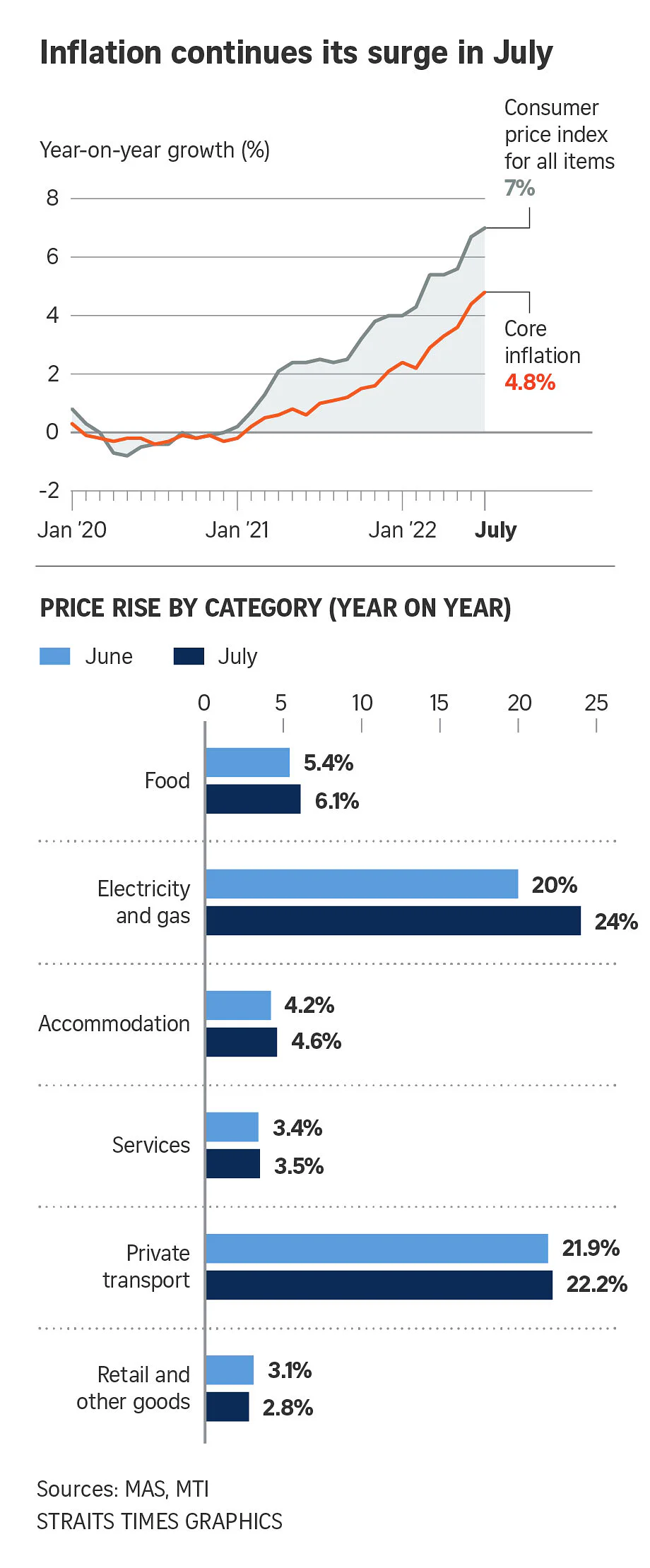

Given this wide spectrum, Singapore's latest headline inflation or headline consumer price index (CPI) of 7 per cent sits somewhere in the middle.

It is not expected to breach the double-digit levels seen in places such as Brazil, Britain and the Netherlands, said OCBC Bank's chief economist Selena Ling.

"For now, I expect Singapore's headline CPI to top 7 per cent year on year, but is unlikely to cross to double-digit territory, barring fresh shocks to global commodity prices and wage-price spirals," she said.

CIMB economist Song Seng Wun said that for Singapore's CPI to go up to double digits, there must be a significant jump in services inflation that would be driven by higher wages, services costs, rentals and certificate of entitlement prices, among others.

He noted that the difficulty in estimating CPI is that not all businesses pass on the higher costs of goods to consumers at the same time.

That said, Mr Song thinks Singapore's fourth-quarter year-on-year inflation might possibly dip on the back of a higher base of comparison.

He pointed out that inflation rates can vary widely because the basket of goods and services used to measure headline inflation differs from country to country.

This is particularly true of the bigger countries, where there are urban and rural areas.

For instance, in Indonesia, food makes up about 40 per cent of the basket, so higher feed costs will weigh on its CPI.

Indonesia's latest inflation rate stands at 4.94 per cent.

Mr Song said: "While we may argue about the different income groups within a city, a country's basket of goods and services will differ significantly from that of a city state.

"For a city (state) like Singapore, food makes up less of the basket than services.

"For services, prices are still clearly rising because they reflect the tight labour market conditions and higher costs of goods that are being passed through to services."

Other factors that matter in CPI include the weighting of the different goods and how the government intervenes.

In Singapore, the Government handed out goods and services tax rebates.

In Malaysia, a price ceiling is set for key goods like chickens.

In Hong Kong, the government has been very aggressive in intervention, giving out rebates or subsidies to help families.

This has enabled Hong Kong to keep its CPI to under 2 per cent, Mr Song said.

Ms Ling noted that inflation drivers in Britain, where CPI rose 10.1 per cent last month, are familiar - they include food, housing and transport.

The country has faced higher fuel prices, especially for gas.

A recent Citi report said Britain's consumer price inflation is set to peak at 18 per cent next year.

Ms Ling said that unlike European countries, Singapore is not as reliant on Russian natural gas.

Similarly, the basket of goods and services in the US is dominated by energy costs, given that Americans drive a lot, noted Mr Song. That is why the US CPI of 8.5 per cent last month slid from 9.1 per cent in June, "brought down sharply by lower (petrol) and energy costs".

In Japan, which has faced deflation in the past, the inflation rate touched 2.6 per cent last month - the fastest pace since April 2014 - as fuel and food prices rose.