CONDOMINIUM projects such as Sky Eden@Bedok and Lentor Modern are setting new benchmarks in Singapore’s property market, amid elevated land and construction costs, yet buyers appear unfazed.

Despite steeper interest rates, high inflation and macroeconomic headwinds, recent suburban launches have seen blistering sales – thanks to demand from HDB upgraders and owner-occupiers, as well as limited unsold supply to choose from. As at Q2 2022, unsold inventory stood at 17,506 units.

After a lull owing to the Hungry Ghost Festival, launched 158-unit Sky Eden@Bedok. It sold 118 units – or 75 per cent of its units – last week at an average price of S$2,100 per sq ft (psf). The 99-year-leasehold mixed-use development is the second major new launch in the Outside Central Region (OCR) this year, following on the heels of AMO Residence in Ang Mo Kio. A joint venture between , and Kheng Leong Company, the 99-year AMO sold 366 of its 372 units in July at a median price of S$2,110 psf.

Other factors adding to the appeal of these projects are a lack of new launches in the vicinity, and being close to an MRT station and schools.

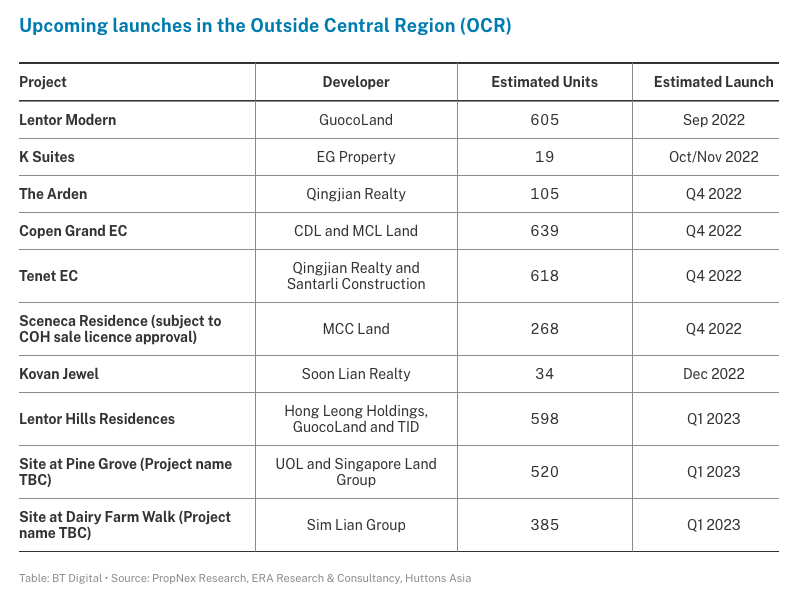

Guocoland’s 99-year, 605-unit Lentor Modern, which is part of an integrated development and linked to Lentor MRT station, is also expected to garner strong sales when it launches on Saturday (Sep 17). Units are priced from S$1,880 psf.

As part of a consortium with Hong Leong Holdings and TID, GuocoLand is also due to launch another project, Lentor Hills Residences at Lentor Hills Road, likely next year. The trio acquired the parcel in January for S$586.6 million, or about S$1,060 psf per plot ratio (psf ppr). The Lentor Modern site was acquired for S$784.1 million or S$1,204 psf ppr in July last year.

DBS Group analysts reckon robust sales for Sky Eden and Lentor Modern will cause supply to shrink further and push average pricing upwards in H2 2022, although at a modest clip.

Developers with mass-market projects in the pipeline are, therefore, in good stead. The sales performance and pricing of Sky Eden and Lentor Modern would give developers a sense of how to position their own upcoming launches.

Other OCR projects in the pipeline include (CDL) and MCL Land’s 639-unit executive condominium (EC) Copen Grand at Tengah Garden Walk in Q4 2022, and UOL and Singapore Land Group’s 99-year, 520-unit residential project at Pine Grove in Q1 2023.

DBS has listed CDL and GuocoLand as its top picks. It noted that while GuocoLand has a larger percentage of unsold inventory among the listed developers, a strong showing when Lentor Modern commences sales should help close the gap.

Meanwhile, keen buyer interest for suburban projects could prompt developers to bid strongly on OCR land parcels under state tenders.

Citi analyst Brandon Lee expects demand for Sky Eden could further whet developers’ appetite for mass market projects, prompting competition for certain sites under the Government Land Sales (GLS) programme.

Against the backdrop of rising interest rates and an increasingly uncertain macroeconomic environment, selecting the right sites for their landbank will help safeguard developers in the event of a slowdown in the market.