Redevelopment under CBD Incentive Scheme

To Be Singapore's Tallest Building at 305m

Developer: Perennial Shenton Property (Alibaba Singapore Holding and PRE 13)

In July 2017, following a backdrop of an increasing number of inquiries regarding the possible sale of AXA Tower, Perennial Real Estate Holdings considered a potential en bloc sale for AXA Tower at a minimum S$1.65 billion.

This was as a result of the improved Singapore office market environment and strong interest in the commercial office segment.

In May 2020, Alibaba, which was already an anchor tenant at AXA Tower, bought a 50% stake in AXA Tower, valuing the property at S$1.68 billion.

AXA Tower has an existing gross floor area of 1.05 million sq ft, and has secured regulatory approval from the Urban Redevelopment Authority to further increase its floor area to 1.55 million sq ft to integrate hotel and residential usage under the CBD Incentive Scheme.

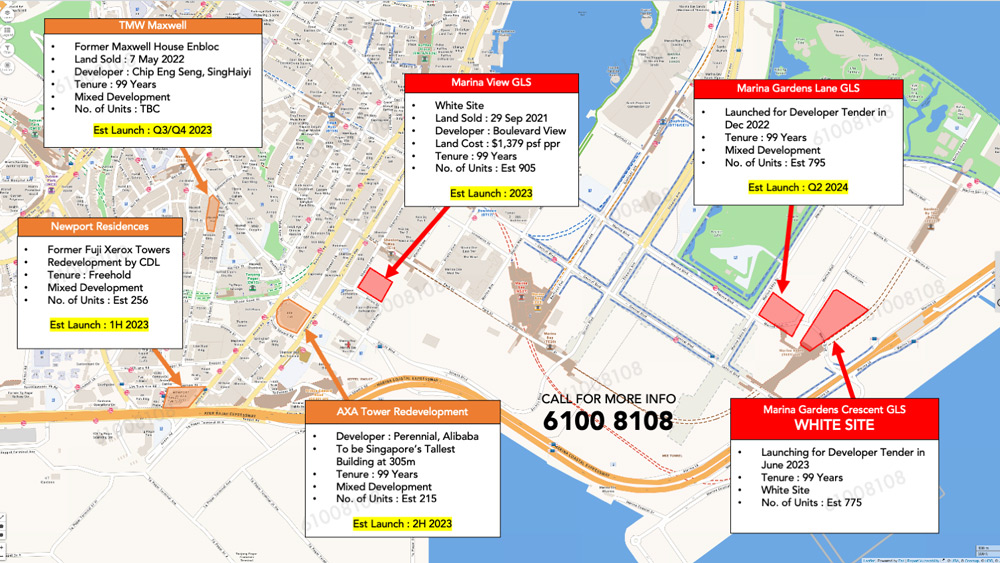

A number of new launches are expected in the CBD and Marina South area, including:

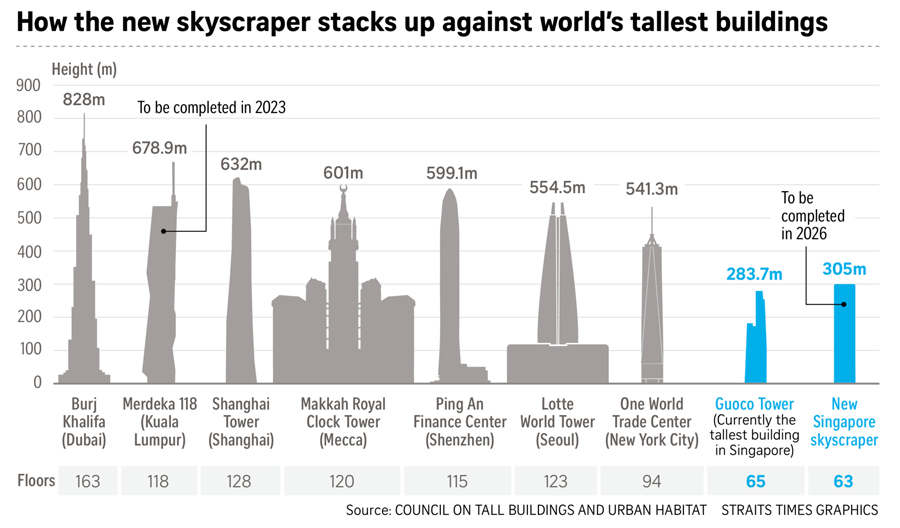

Skidmore, Owings & Merrill has been engaged to redevelop the former AXA Tower site into a 63-storey project

The American architecture firm behind Dubai's famed Burj Khalifa tower will design what will be Singapore's tallest skyscraper.

The Straits Times understands that Skidmore, Owings & Merrill (SOM) has been engaged by Chinese tech giant Alibaba Group Holding and a Perennial Holdings-led consortium to redevelop the former AXA Tower site at 8 Shenton Way into a 63-storey office, retail, residential and hotel project.

SOM, which has earned a reputation for creating ultra-tall structures, will partner Singapore's DCA Architects for the 305m-high development, which will dethrone the Guoco Tower as the city's tallest building once completed by 2026.

SOM designed New York's One World Trade Centre - the seventh tallest building in the world - and Tianjin CTF Finance Centre, the eighth tallest.

The URA has approved a 63-storey development with nearly 1.6 million sq ft GFA, comprising offices, some retail space, 215 apartments and a 11-suite hotel

ALIBABA and a Perennial Holdings-led consortium’s proposed mixed-use project on the former AXA Tower site opposite Tanjong Pagar MRT station is poised to overtake Guoco Tower as Singapore’s tallest development.

The Urban Redevelopment Authority (URA) has approved a maximum height of 305 metres for the proposed 63-storey office, retail, residential and hotel project at 8 Shenton Way. This exceeds the 290-metre height URA approved for Guoco Tower, an integrated mixed development completed in phases between 2016 and 2017.

URA’s spokesperson confirmed that the proposed development at 8 Shenton Way is the only project that has been given the nod to be taller than the 290 metres Singapore Height Datum (SHD) approved for Guoco Tower.

“The approved building height of 305 m SHD (for 8 Shenton Way) is the highest that URA has granted for developments in Singapore.

Chinese e-commerce giant Alibaba Group has agreed to buy a 50 per cent stake in AXA Tower in a deal that values the property at S$1.68 billion, a boost of confidence to the Singapore market amid a downturn caused by the COVID-19 coronavirus pandemic.

A share purchase agreement was made between a consortium of investors led by Perennial Real Estate Holdings to sell the stake to the Singapore arm of Alibaba, said Perennial in a statement on Wednesday (May 6).

A group of investors led by Perennial Real Estate Holdings is mulling the en bloc sale of AXA Tower in Shenton Way for at least S$1.65 billion, following a number of inquiries regarding the property.

Perennial said on Monday (July 31) it had received a number of en bloc sale inquiries for AXA Tower, " as a result of the improved Singapore office market environment and strong interest in the commercial office segment".

The guide price is equivalent to about S$2,150 psf based on a total strata area of about 767,3581 sq ft after renovation works.

AXA Tower Project Details as at July 2017

| Address | 8 Shenton Way, Singapore 068811 |

| Tenure | 99 years expiring on 18 July 2081 |

| Land Area | 118,230 sq ft |

| Gross Floor Area | 1.03 million sq ft (Current) 1.06 million sq ft (Post-AEI) |

| Components | Office 1 50-storey Grade ‘A’ office tower Retail 2 level retail podium Medical (New) 2-storey annex block Car Park 3 basement levels |

| Strata Area | Office: 680,020 sq ft Retail: 60,773 sq ft Medical: 26,565 sq ft Total: 767,358 sq ft |

| Anchor Tenants | AXA Insurance, BOC Aviation Limited, Red Hat Asia Pacific and Lazada South East Asia Pte. Ltd. |

| Car Park Lots | 612 |

| Owner | Perennial Shenton Property Pte. Ltd. |

| Project Manager / Asset Manager / Property Manager | Perennial’s Subsidiaries |

| On-going Enhancement Works | S$140 million works expected to complete in 2019 |

Singapore, 31 July 2017 – Perennial Real Estate Holdings Limited (“Perennial”) and its consortium of investors (together, the “Perennial-led Consortium”) are considering the enbloc sale of AXA Tower at no less than S$1.65 billion, equivalent to about S$2,150 per square foot (“sq ft”) based on its post-asset enhancement initiative (“AEI”) total strata area of about 767,358 1 sq ft. Taking into account the AEI cost of S$140 million that is fully debt-funded which will be borne by the potential new owner, the post-AEI strata value would be about S$2,333 per sq ft. The consideration for enbloc sale follows the receipt of a number of enbloc sale enquiries for the development, as a result of the improved Singapore office market environment and strong interest in the commercial office segment.

AXA Tower, a predominantly-office landmark integrated development, is strategically sited within Singapore’s Central Business District (“CBD”). The development has received strata subdivision approval which provides the flexibility for it to be held as a whole for long-term investment or for sale as individual strata units. Currently undergoing AEI works, the development scheme will create additional areas of about 106,000 sq ft, thereby increasing the development’s post-AEI total strata area to about 767,358 1 sq ft. Separately, AXA Tower still encompasses unutilised gross floor area of about 185,850 sq ft post-AEI, which could be harnessed to create further value.

The AEI includes increasing the footprint of the retail podium spanning Basement 1 and Level 1 to about 60,000 sq ft, building a new 32,000 sq ft two-storey annex block fronting Maxwell Road to house medical suites, improving the efficiency of the offices, upgrading the office lifts with the destination controlled system and integrating with the security turnstiles, elevating the main entrance to street level facing Shenton Way with a brand new office lobby, as well as enhancing the building’s overall connectivity and drop-off points.

The strata sale of selective office floors at AXA Tower was officially launched at the end of 2016. The Grade ‘A’ office’s typical column-free floor plate measures about 14,510 sq ft and is divided into eight strata units, ranging from about 1,745 sq ft to about 1,960 sq ft.

To-date, the total strata sales achieved at AXA Tower is about S$41 million, and the average transacted price of the office units was about S$2,559 per sq ft. Units on the low-zone were transacted at about S$2,450 per sq ft, while those in the middle-zone were transacted close to S$3,000 per sq ft. With impressive unobstructed views of Marina Bay, Singapore Strait, CBD, Tanjong Pagar precinct and Chinatown Heritage District, coupled with private lift access, units on the high-zone are expected to command a price of over S$3,000 per sq ft. AXA Tower also presents ample parking spaces for office tenants as the development enjoys four times more parking provision than new developments in the CBD.

AXA Tower has excellent transport connectivity with underground access to Tanjong Pagar Mass Rapid Transit (“MRT”) Station and the upcoming Prince Edward MRT Station, which is expected to be completed

in 2025. It is also in close proximity to the Shenton Way Bus Terminal and has quick access to major expressways, namely the Marina Coastal Expressway and the East Coast Expressway. Furthermore, the prime development is anchored by multi-national tenants, namely AXA Insurance (Singapore), BOC Aviation, Red Hat Asia Pacific and Lazada South East Asia Pte. Ltd., and leasing interests remain strong with a number of renowned tenants taking up more space at recent renewals.

The Perennial-led Consortium intends to appoint JLL and CBRE as joint marketing agents to manage enquiries on the potential enbloc sale of AXA Tower.

Mr Greg Hyland, International Director and Head of Singapore Capital Markets of JLL Singapore, said, “The positive shift in investors’ sentiment since the beginning of 2017 has been supported by underlying leasing momentum in newly completed projects and positive rental growth in Q2. Over the next two to three years, rental growth is expected to accelerate as new supply is subdued and take up, underpinned by steady economic growth, remains buoyant. Prudent investors are looking to position themselves for this upswing and actively looking for opportunities to deploy capital before values appreciate. There is also an increased interest from foreign buyers who see the relative value of the Singapore commercial market. Although the transaction size is relatively large at S$1.65 billion, the pricing on a per sq ft basis is attractive given that AXA Tower is an iconic Singapore building with a good office address and excellent connectivity.”

Mr Jeremy Lake, Executive Director of Capital Markets Singapore of CBRE, said, “The sentiment towards the Singapore office investment market has been improving as witnessed by the rising prices paid for office buildings and commercial land tenders. Developers and investors are actively looking for opportunities to position themselves for the recovery. With a strata value of about S$2,333 per sq ft, AXA Tower presents a good investment proposition when compared to recent commercial transactions and tender land sales, with further value supplemented by its retail and medical components. In addition, the fact that strata approval has been obtained gives the new owner the flexibility to sell strata units at higher prices which will be made easier by the rising market.”

2 The Perennial-led Consortium comprises Perennial, HPRY Holdings Limited (“HPRY”) and some other investors. HPRY is an investment vehicle which is wholly-owned by Mr Kuok Khoon Hong, who is one of the largest sponsors of Perennial and the Chairman of Perennial. Perennial and HPRY hold equity interests of 31.2% and 10.1% respectively, amounting to a total interest of 41.3%, in AXA Tower.

About AXA Tower AXA Tower is a 50-storey landmark Grade ‘A’ predominantly-office development strategically sited within the CBD and is one of the tallest skyscrapers in Singapore. The prime property enjoys three major frontages along Shenton Way, Anson Road and Maxwell Road, and is located on a site adjacent to the future Greater Southern Waterfront, offering commanding unobstructed views of Marina Bay, Singapore Strait, CBD, Tanjong Pagar precinct and Chinatown Heritage District.

The prime development is connected via an underground pedestrian link to Tanjong Pagar MRT Station and the upcoming Prince Edward MRT Station, which is expected to be completed in 2025. It is also in close proximity to the Shenton Way Bus Terminal and has quick access to major expressways, namely the Marina Coastal Expressway and the East Coast Expressway.