SINGAPORE – Land supply for private housing has been further beefed up for the second half of 2023, taking the total confirmed supply for the year to its highest in a decade.

In all, the eight sites on the confirmed list of the Government Land Sales (GLS) programme announced on Wednesday will yield about 5,160 private residential units, including 560 executive condominium (EC) units, and 4,900 sq m gross floor area (GFA) of commercial space.

This is a rise of 26 per cent from 4,090 residential units in the first half of 2023.

With this latest ramp-up, the total confirmed list supply of around 9,250 units for the whole of 2023 will be the highest since 2013, when 12,913 units were announced.

This is also nearly 50 per cent higher than the supply in 2022, and around 2½ times the supply in 2021.

It shows “the Government’s determination to address the existing market imbalance, where demand for private housing continues to be robust, but supply remains on the catch-up”, said Ms Chia Siew Chuin, JLL’s head of residential research, research and consultancy.

Cushman & Wakefield head of research Wong Xian Yang said the latest injection may not have an immediate impact on prices, as potential new launches may hit the market only in 2025.

| S/N | Location | Site Area (ha) | Proposed GPR | Est Residential Units | Est Comm. Space (m2) | Est Launch Date | Sales Agent |

|---|---|---|---|---|---|---|---|

| Residential Sites | |||||||

| 1 | Clementi Avenue 1 | 1.34 | 3.5 | 500 | 0 | Aug-2023 | URA |

| 2 | Pine Grove (Parcel B) | 2.50 | 2.1 | 565 | 0 | Aug-2023 | URA |

| 3 | Lorong 1 Toa Payoh | 1.57 | 4.2 | 775 | 0 | Sep-2023 | URA |

| 4 | Orchard Boulevard | 0.68 | 3.5 | 270 | 500 | Oct-2023 | URA |

| 5 | Plantation Close (EC) | 2.01 | 2.8 | 560 | 0 | Nov-2023 | HDB |

| 6 | Upper Thomson Road (Parcel A) | 2.44 | 2.2 | 595 | 2,000 | Dec-2023 | URA |

| 7 | Upper Thomson Road (Parcel B) | 3.20 | 2.5 | 940 | 0 | Dec-2023 | URA |

| 8 | Zion Road (Parcel A) | 1.51 | 5.6 | 955 | 2,400 | Dec-2023 | URA |

| Total (Confirmed List) | 5,160 units | 4,900 m2 | |||||

| S/N | Location | Site Area (ha) | Proposed GPR | Est Residential Units | Est Hotel Rooms | Est Comm. Space (m2) | Est Available Date | Sales Agent |

|---|---|---|---|---|---|---|---|---|

| Residential Sites | ||||||||

| 1 | Lentor Gardens | 2.06 | 2.1 | 500 | 0 | 0 | Available | URA |

| 2 | Senja Close (EC) | 1.01 | 3.0 | 295 | 0 | 0 | Available | HDB |

| 3 | Holland Drive | 1.23 | 4.7 | 680 | 0 | 0 | Nov-2023 | URA |

| 4 | De Souza Avenue | 1.91 | 1.6 | 350 | 0 | 0 | Nov-2023 | URA |

| 5 | Tampines Street 95 (EC) | 2.25 | 2.5 | 560 | 0 | 0 | Nov-2023 | HDB |

| 6 | Zion Road (Parcel B) | 0.92 | 5.6 | 605 | 0 | 0 | Dec-2023 | URA |

| Commercial Sites | ||||||||

| 7 | Punggol Walk | 1.00 | 1.4 | 0 | 0 | 13,350 | Available | URA |

| White Sites | ||||||||

| 8 | Woodlands Avenue 2 | 2.75 | 4.2 | 440 | 0 | 78,000 | Available | URA |

| Hotel Sites | ||||||||

| 9 | River Valley Road | 1.02 | 2.8 | 0 | 530 | 2,000 | Available | URA |

| Total (Reserve List) | 3,430 | 530 | 93,350 | |||||

“Nonetheless, the continued ramp-up of supply in the confirmed list signals the Government’s intent to cool price growth. Barring a deterioration in economic conditions, we can expect another increase in GLS confirmed list supply in 2024,” he added.

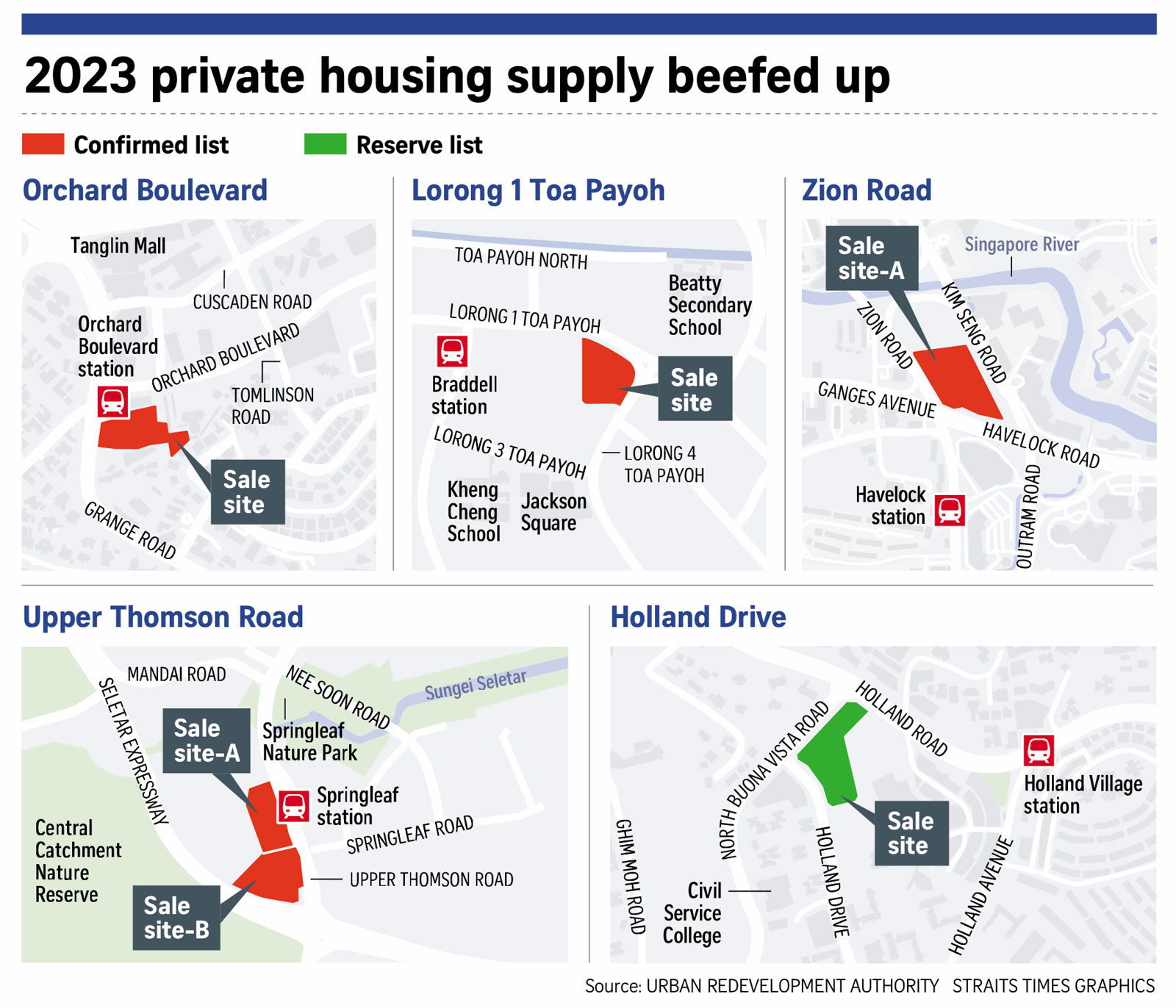

Four of the eight confirmed list sites are newly introduced – Orchard Boulevard, two plots in Upper Thomson Road, and a land parcel in Zion Road (parcel A).

Another four of nine reserve list sites are new – Holland Drive, De Souza Avenue, Tampines Street 95 (EC), and Zion Road (parcel B), according to PropNex.

Analysts noted that about half of the confirmed list supply is in the suburbs, where local demand remains buoyant.

Of the suburban sites, the Clementi Avenue 1 site – wedged between Clavon and The Clement Canopy – will be appealing given its location and proximity to numerous schools, said PropNex Realty chief executive Ismail Gafoor.

“By offering sites adjacent to each other or near existing supply (for example, in Zion Road, Upper Thomson Road, Pine Grove, and Plantation Close), it is hoped that the competing supply of homes in these locales will help moderate land bids,” he said.

Mr Lam Chern Woon, head of research and consulting at Edmund Tie, noted that except for one site next to Orchard Boulevard, the other sites could each yield at least 500 units.

“The choice of the prime sites was carefully calibrated to ensure that supply is not excessive. The Orchard Boulevard and Zion Road sites are attractive, given their proximity to MRT stations on the Thomson-East Coast Line,” Mr Lam said.

Ms Christine Sun, senior vice-president of research and analytics at OrangeTee & Tie, said that despite the latest cooling measures crimping demand from foreigners for prime district property, the Orchard Boulevard site is deemed a “trophy” due to its rarity.

“There has not been a GLS released for sale in this area in the past five years. The last GLS site released was in Cuscaden Road – now Cuscaden Reserve. That site attracted nine bidders then and the winning bid was $2,377.2 per sq ft per plot ratio (psf ppr) in May 2018. Moreover, few new developments in the Orchard area are directly linked to an MRT station,” she added.

The future condominium may be marketed as a super-luxury project, said Ms Sun.

On the Zion Road parcels, Mr Lam noted that although these could yield 1,535 residential units, “we expect strong end-user demand, given its location and proximity to Great World City and Great World MRT station”.

JLL’s Ms Chia said the capital outlay for Zion Road parcel A could be substantial, and the estimated land cost is $1.52 billion, or $1,670 psf ppr. “This confirmed list site is likely to encourage joint ventures between two to three developers,” she added.

While the site could attract healthy interest, Ms Sun noted that the future project may not enjoy views of the Singapore River as the units may be blocked by nearby buildings.

“Just opposite this area is the former GLS site in Jiak Kim Street – the current Riviere. There were 10 bidders then and the winning bid was $1,732.54 psf ppr awarded in December 2017,” she said.

Huttons Asia senior director of research Lee Sze Teck noted that several of the confirmed list sites are near MRT stations or in locations where there had not been any new supply for years.

“It has been eight years since the last GLS for private housing in Lorong 1 Toa Payoh. With five-room flats at The Peak @ Toa Payoh exceeding $1 million... there is a sizeable pool of Housing Board upgraders. The top bid could be more than $1,200 psf ppr,” he said.

The Government has also made available for developers to trigger for sale, reserve list sites that can yield an additional 3,430 units (including 855 EC units), 93,350 sq m GFA of commercial space and 530 hotel rooms.

The reserve list comprises six private residential sites (including two EC sites), one commercial site, one white site and one hotel site.

Mr Lam noted that the Holland Drive site, located near the Holland Village MRT station, will “ride on the rejuvenation of the Holland Village precinct by the One Holland Village project”.

Among the suburban sites, he noted that those in Clementi Avenue 1, Lorong 1 Toa Payoh and De Souza Avenue, where previously launched projects have been fully sold, could draw robust bidding from developers.

“In particular, for the De Souza site, we could expect interest from residents looking to right-size from the landed housing estates in the Toh Tuck and Upper Bukit Timah precincts, he said.

Among the reserve list sites, the Tampines Street 95 (EC) site is most likely to be triggered, Cushman’s Mr Wong said.

“EC demand in the east remains strong, given the strong take-up of Tenet, which is already almost sold out. Given higher private residential prices and an uncertain market outlook, ECs can be a sweet spot for owner-occupiers,” he added.

Collectively, the latest ramp-up will take the total pipeline supply of private housing (including ECs) to about 63,500 units, comprising 50,200 units with planning approval and 13,300 units from GLS sites and awarded collective sale sites that have yet to be granted planning approval.

Of these, about 40,400 units will be completed between 2023 and 2025, which is more than double the 20,000 units completed from 2020 to 2022. This forms part of the total supply of about 100,000 public and private housing units to be completed between 2023 and 2025.

But the Government continues to apply a light touch on commercial and hotel supply, preferring to place the bulk of supply under the reserve list.

Among the reserve list sites is the white site for a mixed-use development in Woodlands Avenue 2 and the short-term lease commercial site in Punggol Walk.

Also included is a site in River Valley Road carried over from the first half 2023 reserve list, for the potential development of more hotel rooms.